Mileage Reimbursement Rate for 2011

Table of Contents

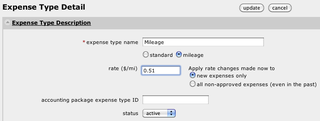

For our U.S. customers, we want to remind you that the federal mileage reimbursement rates will be different starting at the beginning of the year. Thus, as of January 1, 2011, the federal mileage reimbursement rate increased from 50 cents per mile to 51 cents/mile (see the IRS web site for details).

We recommend that you change your company's mileage reimbursement rate in ClickTime if you haven't already done so.

- Sign in to ClickTime (you need to be an administrator).

- Click the "Expenses" link on the menu bar under the Company tab.

- Click the "Expense Types" link.

- Click on the name or "edit pencil" icon of your "mileage" expense type.

- Edit the rate value. For example, enter 0.51 for the new federal rate.

- Choose whether to apply the rate change to expenses that haven't been approved.

- Save your changes.

If your company has multiple mileage expense types, remember to repeat steps 4-7 above for each appropriate expense type. You can also choose to apply the rate change to expenses that haven't yet been approved.

Check out this Wikipedia article if you're interested in how the federal mileage rate has fluctuated over time.