CAPEX AND OPEX LABOR COST CAPTURE

Cost Tracking for CapEx ProjectsMaintaining a CapEx strategy is easier than you think.

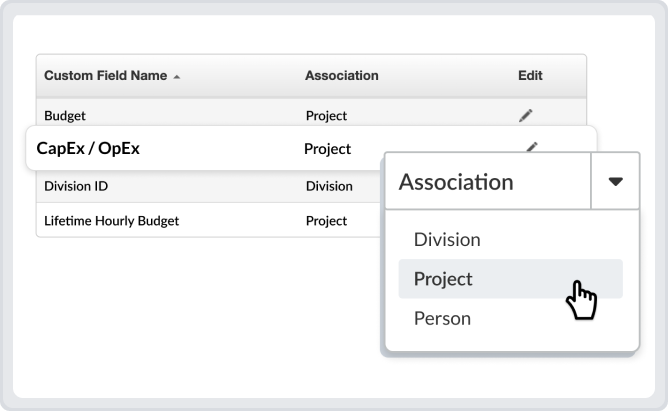

CAPTURE TIME AND EXPENSES WITH EASE

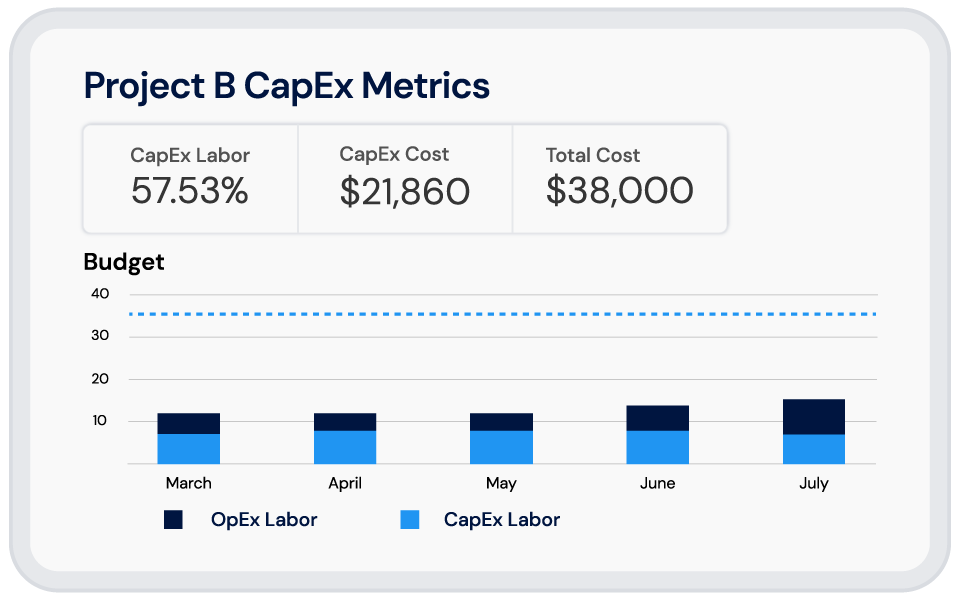

Solidify Your CapEx StrategyClickTime makes it easy to turn raw CapEx time and expense data into actionable insights to ensure regulatory compliance, control budgets, and improve financial predictability – functions that are far more difficult than they should be in a legacy system.

COMPLIANCE, AUDITS, AND TAX STRATEGY

Ensure Financial Reporting ComplianceCapture the right level of detail to accurately classify CapEx labor, support tax strategies, and maintain clean audit trails.

Automate cost tagging and time review

Support tax credit documentation

Maintain audit-ready records across projects

M&A, INVESTMENT FUNDING, AND IPO

Promote Stakeholder ConfidenceMatch labor costs to capital projects and revenue periods. Create a clear picture of asset development for boards, auditors, and investors.

Attribute labor to specific CapEx initiatives

Break down labor spend by asset, team, or region

Support balance sheet accuracy and investment forecasting

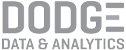

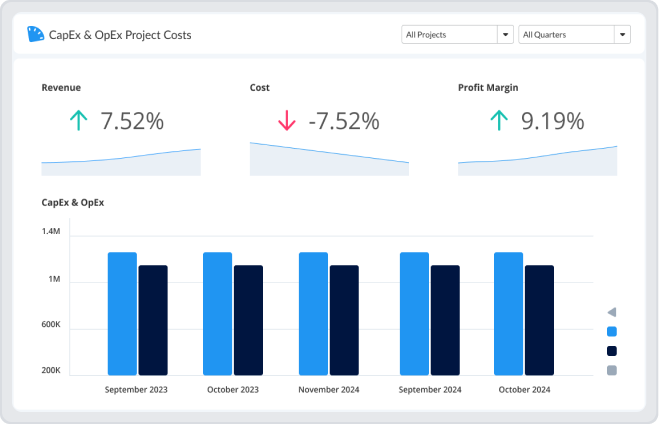

CAPITAL PLANNING AND INVESTMENT DECISIONS

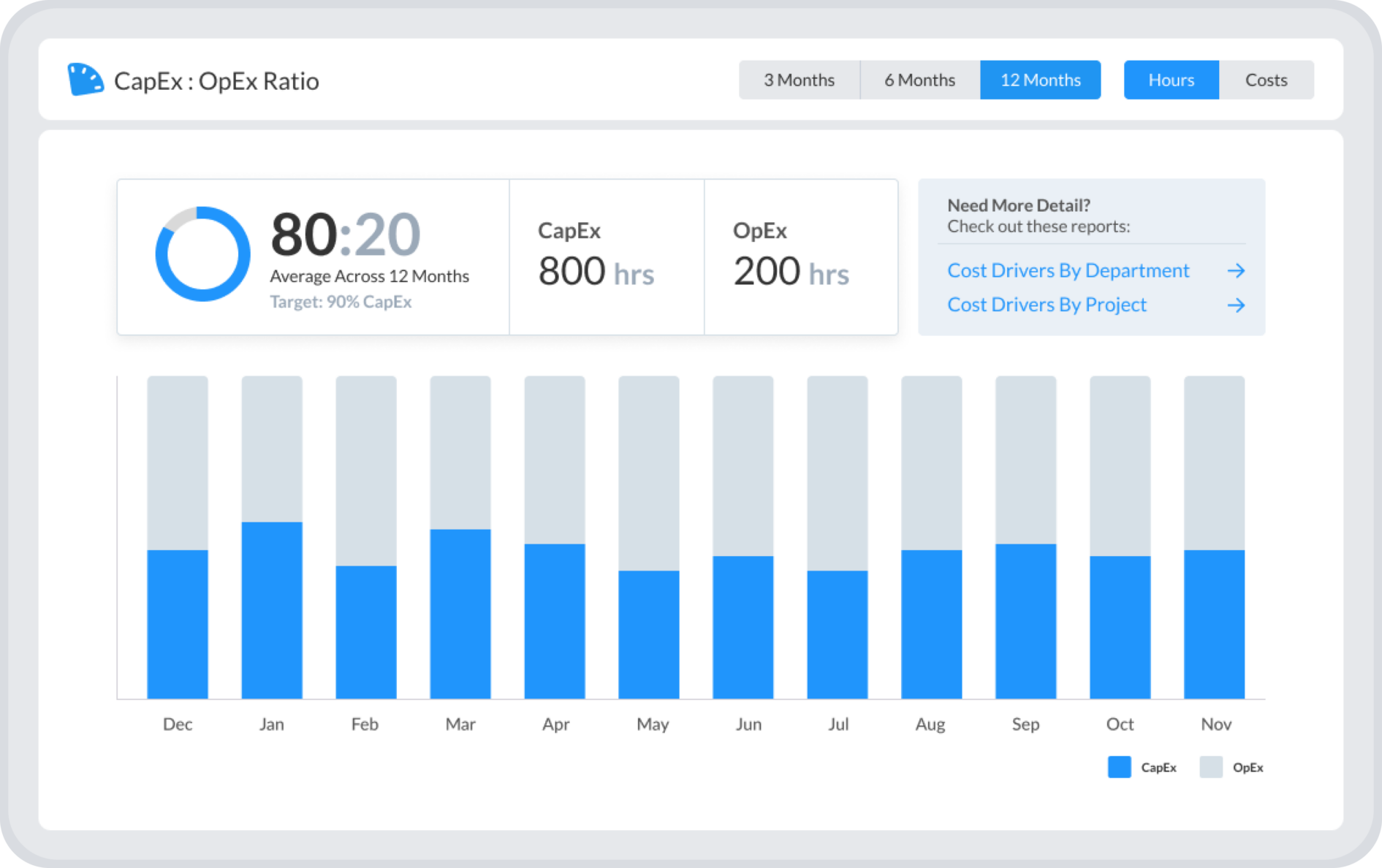

Precise Capital Labor ForecastingUse real-time and historical labor data to forecast CapEx and OpEx needs, allocate resources to high-value initiatives, and stay within budget.

Track hours tied to capital investments

Real-time comparison of actuals versus planned

Shift labor toward value-adding projects