More than Time-Tracking: Make Your R&D Project Data Work for You

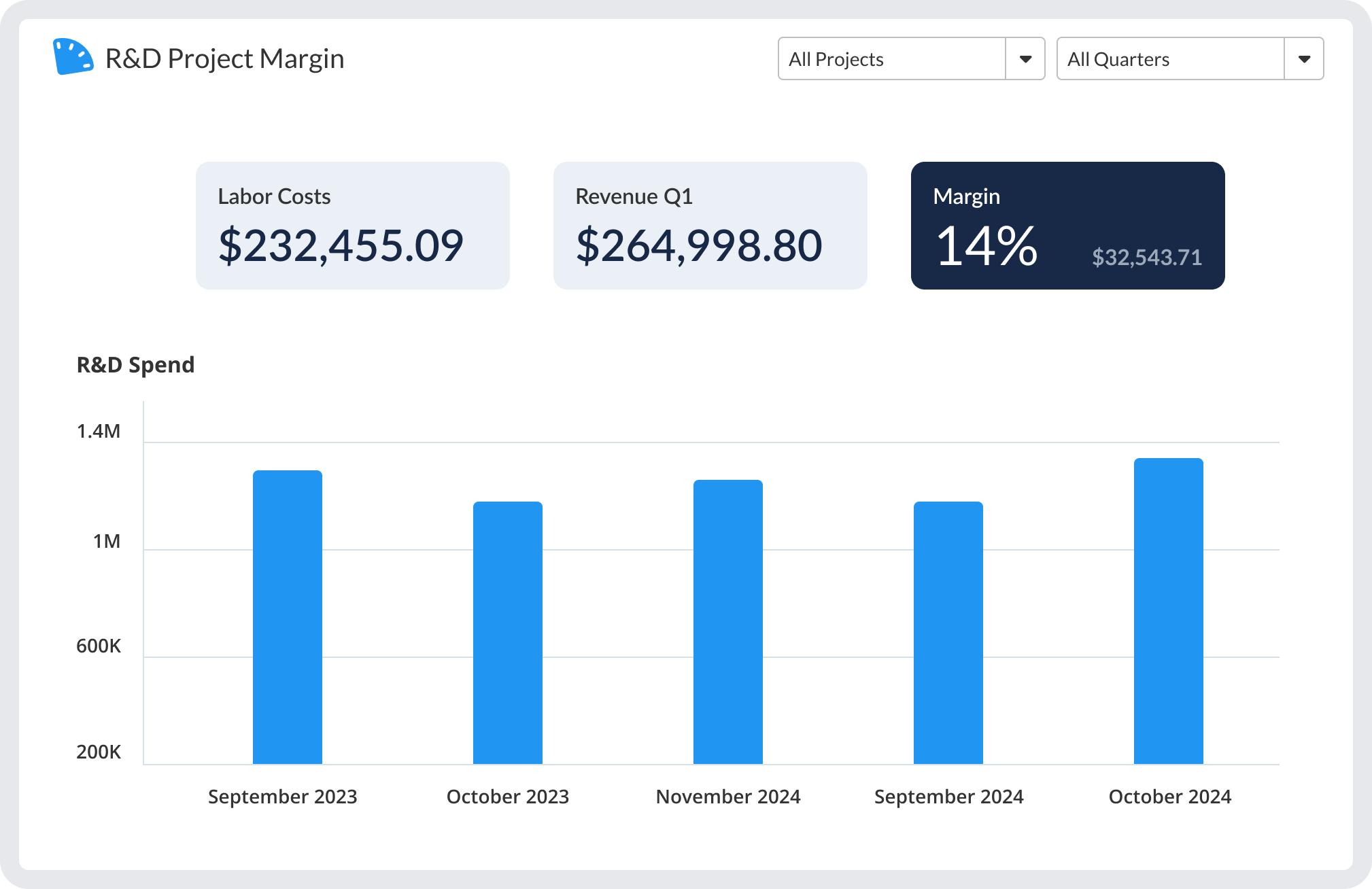

ClickTime supports labor tracking of R&D work as a qualified research expense (QRE) while unfolding a clear picture of alignment with strategic priorities.

Want a 10,000-foot view of ClickTime's capabilities? View our Product Feature Tour.

Explore Feature Tour

Learn how companies like yours use ClickTime every day to improve their workforce's efficiency.

View Case Studies

[eBook] How to Track Time. Get actionable tips for success at every stage of your time tracking journey.

Download the Free Guide

Want a 10,000-foot view of ClickTime's capabilities? View our Product Feature Tour.

Explore Feature Tour

Learn how companies like yours use ClickTime every day to improve their workforce's efficiency.

View Case Studies

[eBook] How to Track Time. Get actionable tips for success at every stage of your time tracking journey.

Download the Free Guide

ClickTime supports labor tracking of R&D work as a qualified research expense (QRE) while unfolding a clear picture of alignment with strategic priorities.

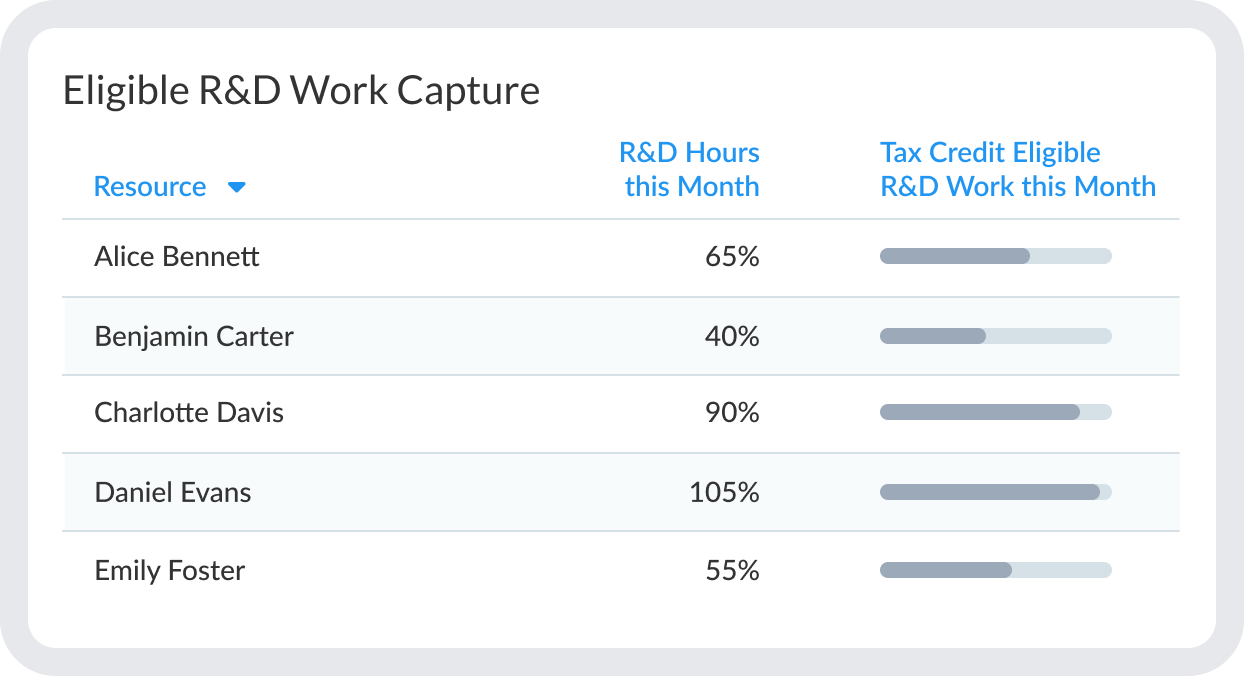

Easily Filter Tax-Credit Eligible Hours

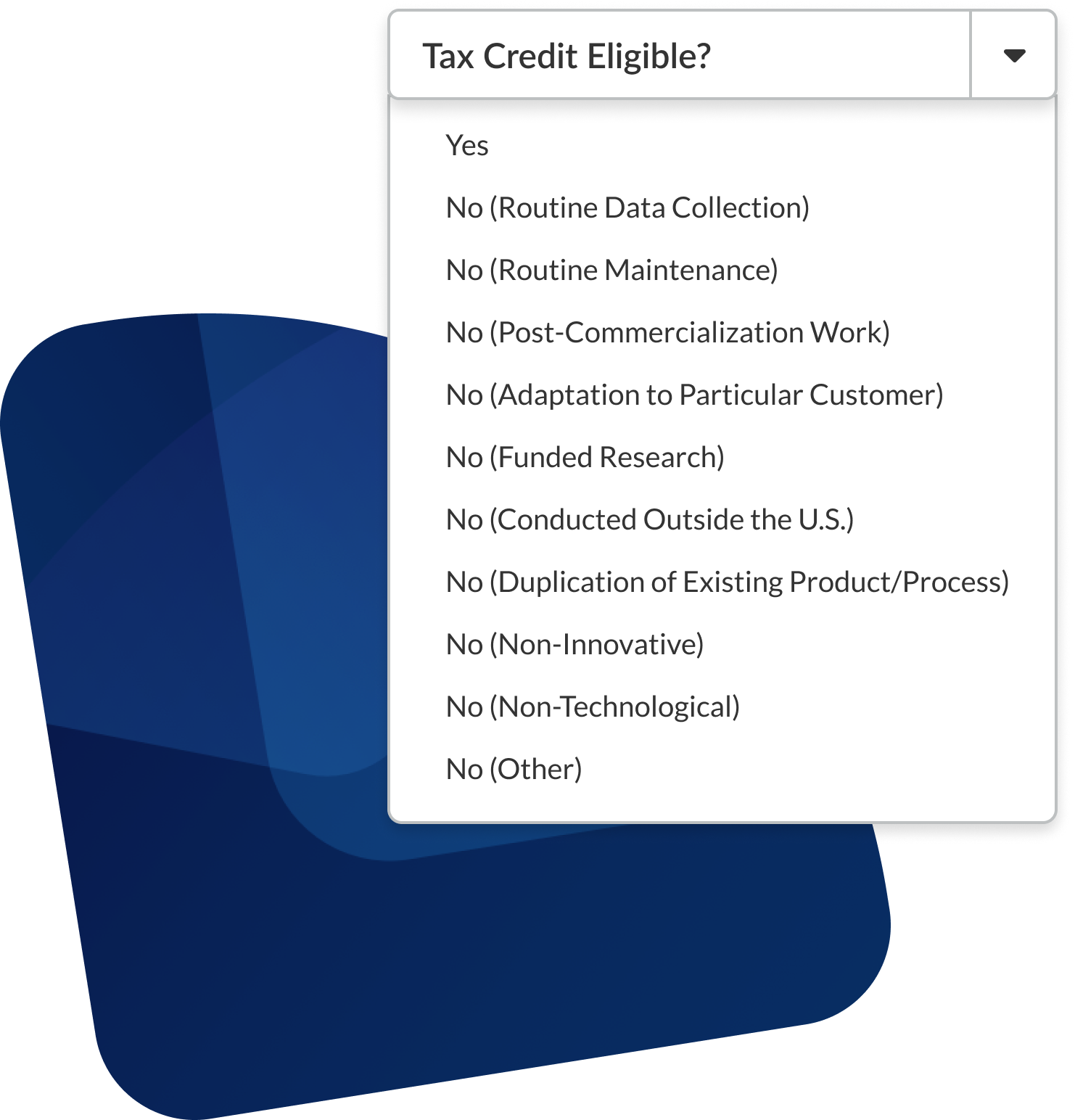

Code Projects Quickly to Categorize Eligible Work

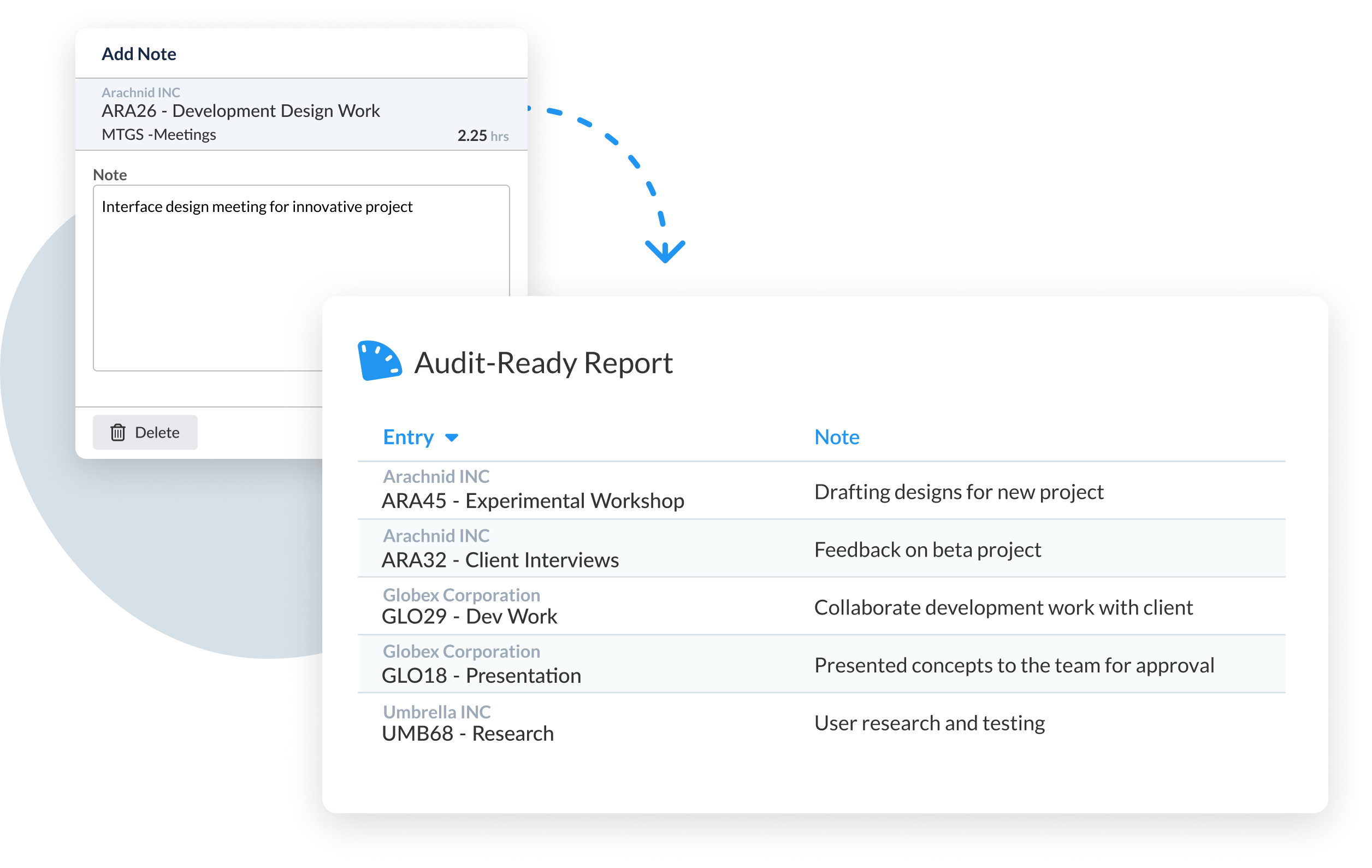

Ensure Audit-Readiness Across Multiple Fronts

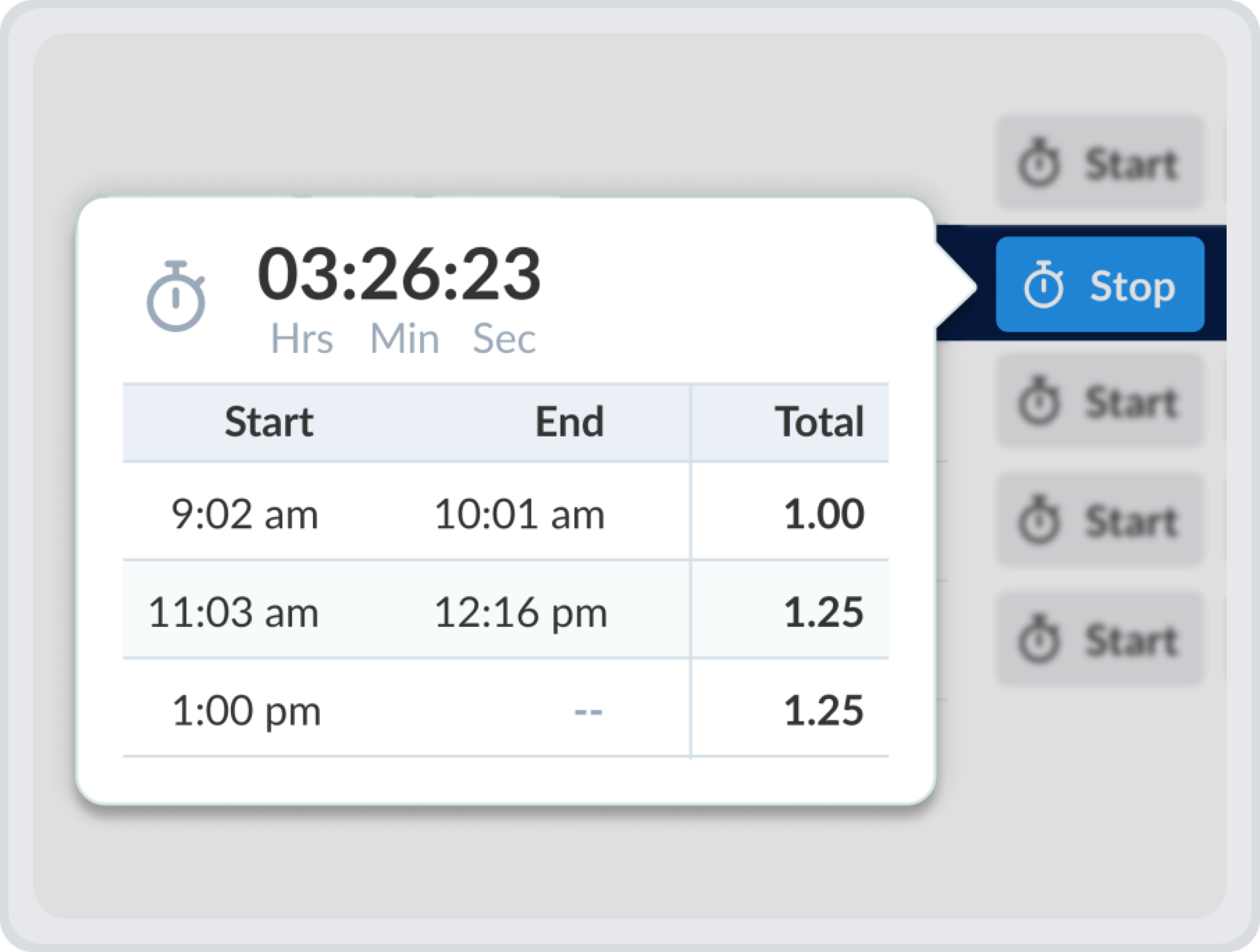

Avoid Unnecessary Disruptions

Add Notes or Fields to Satisfy Qualitative Requirements for Audits

Deep reports built on historical data

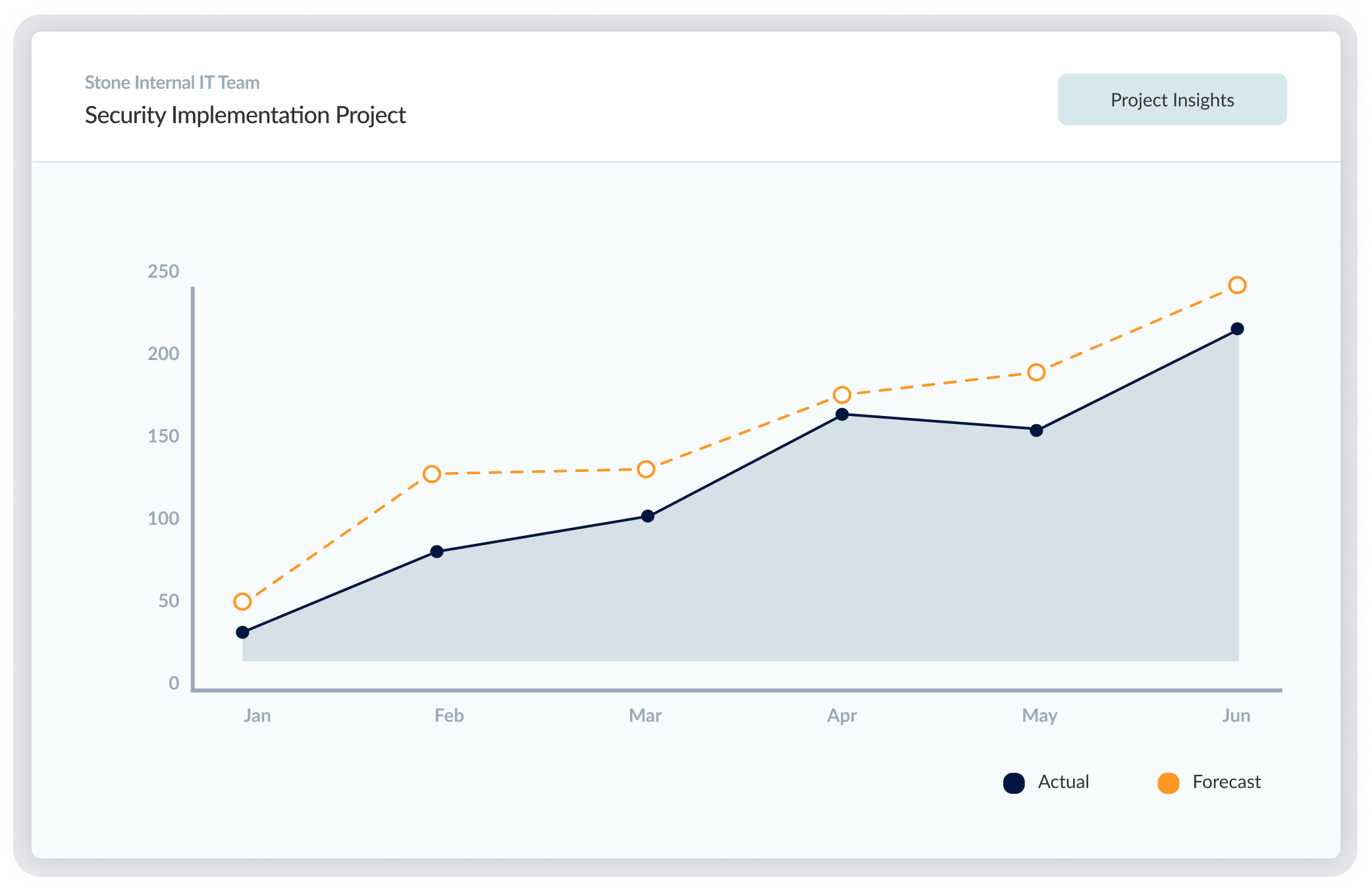

Real-time analysis to stay on target

Tax Credit Compliance

Reclaimed Annually in R&D Tax Credits

Average Proportion of Project Costs Eligible for Tax Credits

It’s easy to fall on the wrong side of time tracking. Too simplistic a tool, and your data isn’t useful. Too complex, and your implementation isn’t finished until three tax cycles from now. Insert ClickTime to your workflows: the perfect balance between lightweight time-keeping and hard-hitting data analysis, all while supporting excellent compliance.

Disclaimer: ClickTime assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness. ClickTime highly recommends working with your CPA directly to determine whether your organization is eligible for R&D tax credits.

We use cookies to make interactions with ClickTime easier and to improve communications. By continuing to use this site, you agree to the use of cookies as described in our Cookie Policy.