STAY UP TO DATE

Want a 10,000-foot view of ClickTime's capabilities? View our Product Feature Tour.

Explore Feature Tour

Learn how companies like yours use ClickTime every day to improve their workforce's efficiency.

View Case Studies

[eBook] How to Track Time. Get actionable tips for success at every stage of your time tracking journey.

Download the Free Guide

Want a 10,000-foot view of ClickTime's capabilities? View our Product Feature Tour.

Explore Feature Tour

Learn how companies like yours use ClickTime every day to improve their workforce's efficiency.

View Case Studies

[eBook] How to Track Time. Get actionable tips for success at every stage of your time tracking journey.

Download the Free Guide

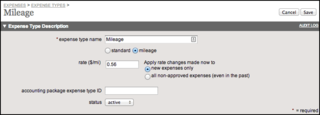

For our U.S. customers, we want to let you know that the IRS announced the federal mileage reimbursement rates for 2014. As of January 1, 2014, the federal mileage reimbursement rate will decrease to 56 cents per mile (see the IRS web site for details).

We recommend that you verify your company's mileage reimbursement rate is set correctly in ClickTime.

If your company has multiple mileage expense types, remember to repeat steps 4-7 above for each appropriate expense type.

Check out this Wikipedia article if you're interested in how the federal mileage rate has fluctuated over time.

Strategic Forecasting Part 3: Modeling Staffing and Productivity Curves for Accurate Financial Planning

Strategic Forecasting Part 2: Building a Calendar System That Anchors Multi-Year Models

Jira for Sprints, not Audits: Why Jira for Audits Won’t Suffice

STAY UP TO DATE

We use cookies to make interactions with ClickTime easier and to improve communications. By continuing to use this site, you agree to the use of cookies as described in our Cookie Policy.