501(C)(3) Nonprofit’s Guide To

Leveraging Federal GrantsIntroduction

Leveraging Federal GrantsFederal grants provide nonprofits with opportunities to receive large sums of money. With so much paperwork and process involved, they can be difficult to win. But if you are approved for a federal grant, you’ll realize all of that hard work was worth the effort.

While all organizations should diversify their revenue streams with different funding sources, it makes sense that nonprofits put so much effort into securing federal money. While the median largest award secured from a community foundation was around $10,000 in 2019, the median largest award from the federal government was over 40 times that amount, around $425,000.

These smaller grants from independent and community foundations are slightly easier to win. But chasing after a highly competitive federal grant — and winning it — could dramatically increase an organization’s overall funding. And huge increases in funding allow nonprofits to dream big when it comes to the work they can do to further their missions.

Unfortunately, these large sums of money come with a tradeoff. Federal funding requires opening your organization — or more specifically your general ledger — up to large amounts of scrutiny from auditors.

To prepare for an inevitable audit, your nonprofit will have to become extremely organized. You’ll have to create plans and processes that will help you stick to the budget you proposed in your grant application. And you’ll likely need to invest in and implement various types of software and tools — largely for accounting, time tracking, and grant management — if you haven’t already.

But even with all of the preparation, changes, and overall hassle that comes with federal funding, the chance at hundreds of thousands of dollars in grant money is often too appealing to turn away from.

If you’re thinking of going after a federal grant — or are worrying about managing one you’ve already secured — you can take a deep breath. We’ve created this guide to help nonprofits like yours not only manage federal awards, but also leverage your funding effectively. From application to audit, use this guide to help your organization navigate federal funding.

Federal Grants, Section 1:

Winning Your Ideal GrantBefore you receive a federal grant, you have to apply for one. And pulling together all the necessary information and creating the required plans for money you might not even receive can be stressful.

But first thing’s first: how do you even find a grant your nonprofit is eligible for?

Winning your Ideal Grant, Part 1:

How to Find Grant Opportunities

There are currently over 1,000 federal grant programs that 501(c)(3) nonprofits can apply for. These grants provide funding for causes ranging from reforming the juvenile justice system, to promoting gender equality through music, to discovering if people could ever live on the moon. So your first step is to narrow down your options to target grants you might actually have a shot at winning.

Fortunately, the federal government has an easy four-step process for finding grants that are right for you. You can find more detail on Grants.gov, but below is a quick summary.

1. Know your nonprofit’s status.

This first step is easy. You’re a “nonprofit having a 501(c)(3) status with the IRS, other than institutions of higher education,” according to the federal government. (And if you’re not, this guide might not be as helpful for you. Sorry!)

Check that box on Grant.gov’s Search page (a free database of federal grants), and your open grant options will likely be cut in half.

2. Pick a keyword that aligns with your mission.

Here’s where the process becomes a little less straightforward. Depending on your mission, you might be able to search multiple keywords to find grant opportunities. And even slightly different searches for relatively similar words will turn up different results.

For example, a search I ran for “homelessness” resulted in 15 grant opportunities, while the more general term of “homeless” resulted in 24 grants. And within those searches, grants had different focuses, ranging from assisting youth experiencing homelessness, helping unhoused victims of domestic violence, and even funding for nonprofits whose work both impacts people without homes and responds to the climate crisis.

So playing around with search terms to find grants you might be eligible for can take up a significant amount of your time before you even start filling out applications.

3. Comb through the eligibility requirements for each grant.

Once you’ve created a list of promising grants, it’s time to read the fine print to see if your 501(c)(3) is actually eligible. After all, you wouldn’t want to waste two workweeks applying for a grant you can’t even win.

Eligibility requirements might be included in the grant’s profile on Grants.gov. But if it’s not, you’ll have to head to the grant-making agency’s site to find the funding opportunity announcement (FOA) document.

4. Contact the agency for any other questions.

If you’re still not sure if you’re eligible, find the agency point of contact (which should be included somewhere in the FOA) for more information.

Winning your Ideal Grant, Part 2:

How to Apply for Federal Grants

If you’ve used the Grant.gov database to find a grant, you can find a link to the grant’s application directly from the database. Otherwise, you should be able to find an application kit on the grant-making agency’s website.

But hunting down the application kit is probably the easiest part of the process. And filling it out involves more than just signing a few forms.

Applying for just one federal grant application can take an average of 80 to 200 hours, total. On the surface, that adds up to two to five 40-hour workweeks. But that’s if one person dedicates all their time to your application.

That’s potentially possible if you hire a dedicated grant writer who understands the importance of deadlines. However, grant writers can charge anywhere from $25 to $150 per hour depending on their experience level and proven success rate. So even a cheaper writer working quickly will cost around $2,000 per grant. And since you’re chasing competitive federal funding, you’ll likely want to hire a more experienced writer with a proven win rate.

And even if you decide to hire a grant writer to put your application together, you’ll still have to meet with your team to put lots of critical information together. But your grant writer will need more than just a few Excel files and mission statements. According to fundraising experts at Get Fully Funded, a grant writer will typically require:

- Detailed financial reports showing previous spending and proof of responsible stewardship.

- A case statement to explain why your organization is deserving of funding.

- Any past grant applications to help explain your programs and the language you use to describe them.

- Data that shows how you’ve impacted your community or the groups you serve.

- A detailed description of the impact you hope to make with grant funding.

- A designated point of contact to answer any questions your grant writer has.

- Proposal summary — Outlines your project, why it’s important, and why you deserve funding

- Introduction of your organization — What your nonprofit does, what your goals are, and your history of managing funding

- Needs assessment — The problem grant funding will solve and how you plan to use the federal award

- Project objectives — Your goals for your funded program or project and how you’ll measure success

- Project methods or design — How your project will function (including staff, activities, services, etc.) and, if you’re smart, how it’s different from anything being done by other organizations

- Project evaluation — How and when you’ll measure project outcomes and impact

- Future funding — How you’ll keep the project going when federal funding runs out

- Project budget — A detailed plan for how you’ll use the funding

So whether your team is applying for a grant or you’ve decided to outsource it to a professional, it will take lots of time, lots of collaboration and communication, and lots and lots (and lots) of documents.

But whoever puts your application together, most grants are composed of the same basic elements:

Winning your Ideal Grant, Part 3:

How to Create a Grant BudgetEach part of your application should be written with care. However, since your grant budget should include historical data and real numbers, it requires more attention than other sections.

Within your application kit, you should find a template for your grant budget proposal. If a template isn’t included, avoid starting from scratch by using a free grant budget template or modeling your budget after one of these examples.

Once you’ve found a format that works for you — or, more importantly, for your grant-making agency — it’s time to start pulling your budget proposal together. There are several main steps that go into creating a grant budget. You can learn more about building your budget from our in-depth blog post, “How to Write a Grant Budget to Win Your Dream Grant.” But below is a summary to get you started.

1. Find out what your funder will cover.

Grants will typically fully cover direct expenses for line items such as supplies or program employee salaries. However, indirect expenses (those related to your organization’s overhead) can be a different story. And the type and amount of indirect expenses you can expect to be reimbursed for will differ by grant or agency.

You’ll also need to understand whether you need to provide matching funds (expected, committed, or received) for a certain grant. Even if matching funds aren’t required by the grant-making agency, showing that other foundations or donors are willing to invest in your cause can help to make the case that your mission is worthy of funding.

2. Work with your team to estimate realistic costs.

If you’ve already run a program and are seeking to expand it with federal funding, you can pull historical data from your accounting or time tracking tools to build estimates. Even if you’re looking to start a new program, historical data from other projects will give you some decent ballpark figures. Where you don’t have historical data to help create realistic estimates, your program managers and accountants will be vital resources.

Even if you have one person putting a budget proposal together, you should always submit it to your team for review to make sure everything looks correct and realistic. Realistic costs are critical for grant budgets because they:

- Show your team did their due diligence in researching program costs.

- Are difficult and sometimes impossible to change after you’ve been approved for funding.

3. Check your work.

Even if you feel like you’ve gone over your math one thousand times, check it again. Grant-making agencies look at hundreds — even thousands — of applications in a short period of time. Errors will show that your team doesn’t pay attention to detail and could encourage an agency to reject your application in favor of an organization whose math checks out.

Once you’ve checked (and re-checked and re-re-checked) your work, you’re ready to submit your application.

Federal Grants, Section II:

Building the Right Team to Service Your GrantsWhile you’re waiting to hear back from the federal agency that issues the grant you applied for, you might find yourself contemplating the unpredictable nature of nonprofit funding. If you win a federal grant, for example, you’ll likely need to make changes to meet your stated goals.

Planning to purchase more materials and supplies with your new funding will be relatively simple. But acquiring more talent and manpower to help meet your grant objectives is a less straightforward process. And while you’ve dedicated a certain amount of your funding to program payroll, you’ll have to ask yourself several important questions:

- Will you be able to sustain this level of staffing if or when you stop receiving grant funding?

- Should you hire full-time, permanent staff to run your program, or should you take on temporary or part-time staff and contractors?

- How can you plan ahead to keep your nonprofit staffed correctly, even with all of the fluctuations that will occur with your funding?

After turning in your grant applications, shifting your focus to nonprofit capacity building will help your organization feel more stable, with or without grant funding.

Building the Right Team, Part 1:

Focusing on Nonprofit Capacity Building to Improve Your OrganizationNonprofit capacity building is the practice of improving your organization’s overall effectiveness. In slightly less general terms, that means looking at ways you can run your nonprofit so you can better serve your mission.

Applying for a federal grant could have been a result of a discussion around nonprofit capacity building. But improving your organization involves so much more than simply increasing revenue. Taking a more holistic view of how your nonprofit functions and identifying where you could or should make changes can help you:

- Build an organization with more stable funding.

- Manage a productive staff.

- Run impactful programs.

- Spread the word of your mission more effectively.

But since you’re looking at a potential staff increase if your federal grant application gets approved, let’s focus on maintaining the right staffing levels for your nonprofit.

Building the Right Team, Part 2:

How to Manage Staff Fluctuations Alongside Inevitable Funding Fluctuation

Even if you win a federal grant for your program, your nonprofit’s funding will likely always fluctuate. You can (and should) try to get ahead of these fluctuations by diversifying your funding sources. But since payroll typically accounts for 45% to 65% of nonprofit budgets, getting a handle on staffing is also critical for navigating funding changes.

You can learn more about nonprofit staffing strategies in our in-depth blog post, “Maintaining Proper Staffing Levels for Nonprofit Capacity Building.” But below are a few highlights to help you manage your staffing needs.

Use historical data to better understand what you can do with more staff.

Using employee timesheet data can show you the amount and type of work your staff can complete at its current level. By knowing what you can achieve now, without making any changes, you can better understand how much more work you’ll have to do to meet your goals.

For example, increasing funding is crucial if you have a goal of feeding 10% more families this year than you did last year. But you’ll likely also have to hire more people to purchase, prepare, and distribute those meals to meet your goal. Timesheet data can show you how many hours it takes to run your program at its current capacity. And with those numbers in mind, you can decide how many more people it will take to feed 10% more people.

In short, historical data can help you meet your goals and avoid over- or understaffing your programs. Keeping staffing at the right level will also help you prevent burnout, ensuring you can retain talented employees who contribute to the success of your programs.

Know what a skeleton staff will look like.

In the worst case scenario of a dramatic reduction in funding, you’ll need to understand which staff members you have to retain in order to keep operating. While calculating your bare minimum staffing level isn’t nearly as fun as making staff projections based on unlimited funding, it’s still important. Knowing your bare minimum can tell you the amount of funding you need to obtain just to keep your doors open.

Historical timesheet data can also come in handy here. You can mine it to show you which employees work on which tasks and programs and how many hours it takes them. From there, you can make difficult decisions about which tasks — or even programs — might become superfluous if your funding drops.

Check in regularly on overall staff performance.

You shouldn’t limit turning a critical eye to staffing when you’re about to receive — or when you’ve already received — a grant. Instead, you should plan to check in on staffing levels and how they help you achieve your goals on a regular basis.

If you’re not meeting your goals, for example, you might be understaffed. Your employees could be burnt out and unable to perform at their full potential. Even hitting milestones long before they’re scheduled could be an issue, as it could indicate that your staff doesn’t have enough to do.

Finally, if you find your staff or contractors are continually working overtime, you definitely need to make some staffing changes. Consistently working more than a full workweek is sure to cause burnout eventually. But overtime payments will wreak havoc on your grant budgets, causing you to spend more on staff salaries than you calculated and potentially leading to dipping into unrestricted funds.

Conducting regular evaluations of performance will help you match your staffing levels to your workload before an imbalance causes a mass exodus due to burnout or boredom.

Start resource planning.

Resource planning helps you allocate employee hours to different programs and projects based on their budgets. Especially if you win a federal grant, you’ll want to start using a resource planning tool to track, allocate, and communicate workload expectations.

By creating and sticking to your payroll budget plans, you can run your programs efficiently and avoid needing to dip into unrestricted funds to cover unexpected costs.

Build a multi-talented staff.

Every organization wants to hire highly talented employees. Nonprofits, especially, should hire and retain cross-departmental staff. By employing people who can work across multiple disciplines, you’ll be able to cover critical tasks, even if your funding decreases.

However, employees won’t always come to you with a varied skill set. To ensure you always have a multi-talented team on board, you should plan to invest in cross-training staff members. Fortunately, some grants will cover a portion of employee training costs, so you can include it in your budget proposal. Even if you have to use unrestricted funds, remember that employing a highly skilled staff is never a bad thing.

By focusing on maintaining the proper staffing levels at your nonprofit, you can better weather funding fluctuations. With a diversified funding stream, along with a staff that can work across different departments and programs, you can ensure your nonprofit can keep working toward its mission even when the budget is tight.

You should definitely take some time to celebrate after securing competitive funding. But you should also be aware that the next step in leveraging federal funding is planning how to spend it. And it’s not as simple as making a withdrawal from a federal checking account.

Managing federal grants involves lots of planning, collaboration, and coordination. Below are a few tips for staying on top of all the work organizing federal funding involves.

Managing your Federal Funding, Part 1:

Equip Yourself with Critical ToolsManaging federal grant funds requires lots of documentation. In order to stay on top of all that documentation, you should invest in software that will help track, manage, and report on all the data you’ll need to collect.

Fund accounting (or nonprofit accounting) software can help with managing your general ledger. Time tracking software can help you track and report on employee hours for internal and auditing purposes. And grant management software can help you stay on top of important deadlines associated with your grant.

Managing your Federal Funding, Part 2:

Define Your Programmatic Activities and Create a TimelineOnce you have the necessary tools in place, you can take a closer look at your grant funding regulations and how they relate to your program.

While you calculated a cost for overall payroll spending in your grant budget proposal, that still leaves you with a lump sum of money. To allocate funding for staff wages to your grant, you’ll have to define your programmatic activities — or activities directly associated with running your program that qualify for reimbursement from your grant.

Next, you’ll essentially have to create a time budget — a plan for how much time you have and when you’ll use it — alongside your grant budget. This might seem straightforward, but it’s actually pretty complex. For example, let’s say you have an employee whose annual salary is $48,000. This employee’s salary is covered by two year-long grants, which equally fund the two different programs they work on (amounting to $24,000 each, per year). Basic math might tell you to allocate $2,000 of programmatic payroll expenses to each program, each month. And that’s okay…as a starting point.

The actual math of this situation is a bit more complicated. Let’s say that one of the programs your employee works on is an afterschool program, and the other is a summer camp. That means during the academic year, your employee will likely have many more programmatic activities related to one program, covered by one grant. But in the summer, more of their time and effort will shift to this other program, meaning a higher percentage of their wages will be allocated to this second grant.

While you can draw from either of these grants for most of the year, your employee doesn’t spend an equal amount of time on these programs every month. Your timeline for programmatic activities should take these fluctuations into account.

Managing your Federal Funding, Part 3:

Align Your Grant’s Drawdown With Your Program’s TimelineAfter creating a program timeline, you’ll need to align it with your grant timeline. Let’s return to our example of an employee who works on an after school program and a summer camp to see how this works.

The grants that cover your employee’s salary are both yearlong grants. However, when you looked more closely at how your employee splits their time between two programs, it looks like something closer to this:

Focusing in on the summer school program, while your grant timeline is one year, you’ll only need to plan to draw down from it to cover your employee’s salary for eight months. And those amounts you’ll have to draw down will differ each month as your employee’s involvement with the program increases or decreases. Meanwhile, you’ll have to draw on your after school program grant fairly steadily for 11 months out of the year.

Focusing in on the summer school program, while your grant timeline is one year, you’ll only need to plan to draw down from it to cover your employee’s salary for eight months. And those amounts you’ll have to draw down will differ each month as your employee’s involvement with the program increases or decreases. Meanwhile, you’ll have to draw on your after school program grant fairly steadily for 11 months out of the year.

You’ll need to ensure your employee’s salary is fully reimbursable by both grants all year according to the programmatic activities they work on at any given time. So instead of using the simple math of spreading your employee’s full salary equally across two grants and 12 months, aligning your program timeline with your grant timeline will give you a draw-down plan that looks closer to this:

Managing your Federal Funding, Part 4:

Make a Plan to Stick to Your PlanWhen you create a grant budget proposal for the federal government, your numbers are fairly set in stone. It’s relatively easy to spend what you allotted for expenses like supplies and materials. Their costs are more likely to stay relatively steady over time. And you might only have to make one-time purchases depending on your program needs.

However, as we’ve seen from our example of an employee who splits their time between two different programs, associated payroll expenses can fluctuate dramatically depending on your program’s timeline. But planning for these fluctuations is something you should do to manage your grant funding effectively and responsibly.

To manage and track payroll expenses so you don’t burn through your funding too quickly, you should invest in:

- Timesheet software — To track employee hours by program, project, and task.

- Resource planning software — To assign hours to employees by program or project, based on your payroll budget allocations.

Timesheets will help you see how your employees are spending their time so you can allocate their wages to a grant, of course. But they’re also highly recommended as an internal control system to keep accurate records of employee time. In an audit situation — which will happen if you receive federal funding — you’ll need a reliable, unmodified account of your employees’ time to hand over to auditors.

And while you don’t need a resource planning tool from a compliance perspective, it will help you view your employees’ hours in real time, as they relate to your program’s payroll budget.

Managing your Federal Funding, Part 5:

ClickTime Can Help Your Nonprofit Better Manage Federal GrantsClickTime’s employee timesheet software can help you track employee hours so you can stick to your payroll budgets. Our resource planning tool can also help you document those plans in one place, where program managers, grant managers and accountants can see them. And once you’ve plugged your plans into our resource planning grid, the hours you’ve assigned to employees for the pay period will show up on their individual dashboards. This continuous circle of communication around hours, wages, and budgets helps everyone on your nonprofit staff stay informed. Learn how ClickTime can help your nonprofit optimize grant funds.

Managing your Federal Funding, Part 6:

Issue Transparent Reports (Internally and Externally) on a Regular BasisOnce you’ve made your plans and equipped yourself with the tools to stick to them, it’s time to prepare for the reporting process. Most grants, federal or otherwise, will have their own reporting requirements. Depending on the grant, you might only have to issue an annual report. However, some might require monthly or quarterly reports. And all will require some form of invoicing or reimbursement request to issue funds or track spending progress.

No matter the cadence, a typical grant report will include:

- Financial statements.

- Grant activities.

- A summary of outcomes and impacts.

- Challenges you faced and the lessons you learned from them.

- What you’re planning to do next to continue working toward your mission.

All of these documents and summaries will, of course, communicate progress to your program officer. But every part of a grant report is also useful for your nonprofit to understand how you’re doing in real time. While you don’t want to spam your program officer’s inbox with reports they didn’t ask for, you should make a habit of creating grant reports for internal use.

Issuing reports internally will help you course correct any programs that are off track and serve as tools you can use to craft official grant reports to send to your grant-making agency.

Federal Grants, Section IV:

Perfecting Wage-to-Grant Allocations with Time StudiesAfter winning your grant and making a plan for spending, the whole lifetime of your grant will stretch out before you. Since you’ve made a spending plan, you know how you’re planning to allocate funding every month or between certain project milestones.

But in between those milestones, there’s a whole lot of work to be done. And you need to get in the habit of tracking all of it. Using timesheets can help to track the work your staff does — and they’re also required according to 2 CFR 200 regulations. But the data derived from timesheets can also help you optimize your hard-won grant funding.

With timesheets, you can conduct a time study. Time studies will help you allocate current grant money to employee wages and plan for grant spending in the future.

Wage-to-grant Allocations & Time Studies, Part 1:

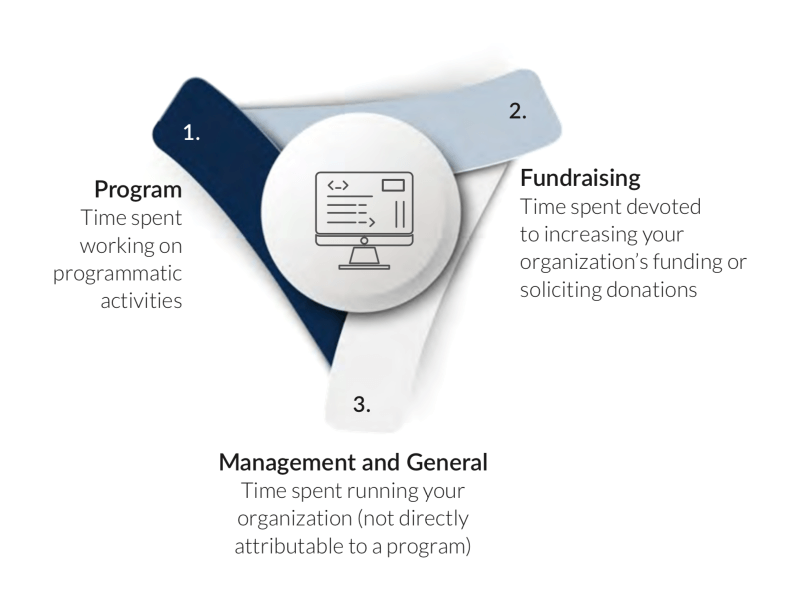

What is a Nonprofit Time Study?A nonprofit time study is a deep dive into where your employees’ time goes. For accounting purposes, a time study mainly shows how your organization’s time is divided between three different types of expenses:

- Program — Time spent working on programmatic activities

- Fundraising — Time spent devoted to increasing your organization’s funding or soliciting donations

- Management and General — Time spent running your organization (not directly attributable to a program)

Time studies are critical because they can show you what portion of your time — and what portion of your employees’ salaries — could be reimbursable from a federal grant perspective.

Since grants fund programs, time spent on most programmatic activities will qualify for salary reimbursement. However, many grants will also allow you to allocate a certain amount of funding to indirect (management and general) expenses, including staff salaries.

To allocate funding to either a direct (programmatic) or indirect (management and general) salary expense, you need to understand how much time was spent doing which activities. And to do that effectively, you need some sort of reliable time tracking method.

Wage-to-grant Allocations & Time Studies, Part 2:

Track Time at a Granular Activity Level to Conduct a Time StudyIf you really want to know where your employees’ time goes (and how much of it is reimbursable), you’ll have to track time at a very detailed level. Whether you do this in spreadsheets or software, you’ll need to ensure that the data you receive from timesheets is accurate, thorough, and detailed.

Averages won’t cut it here. And the more details you have about how time was spent, the better you can run your programs. Designating between program, fundraising, and management and general expenses is a first step — and is required when you’re drawing down from a grant. But when you can see how much time goes into different aspects of your programs — or even your overhead activities — you can better understand what your grants actually fund in terms of wages.

Wage-to-grant Allocations & Time Studies, Part 3:

Allocating Time EffectivelyFor effective wage-to-grant allocations, you’ll need access to two major tools.

1. Fund Accounting Software

Looking at a nonprofit’s funding sources should be like looking at the plate of a picky eater: nothing should be touching. Funds should be separated into restricted (anything designated for a specific use) and unrestricted (for general use) categories. And within your restricted funds category, each funding source (typically a grant or endowment) should be distinct from one another.

When you start allocating wages to each grant, you’ll have to draw from each fund according to the time spent working on reimbursable activities.

Fund accounting software helps automate various accounting processes. But most importantly, it helps you separate your funding sources and allocate expenses appropriately, according to fund accounting best practices.

2. A Standardized Method of Tracking Time

We can argue about the benefits of using software (automates and timestamps tasks) versus spreadsheets (free) to track time all day. But what we can’t argue about is the need for you to standardize your time tracking process so you can accurately, thoroughly, and compliantly record employee timesheets.

Especially when you receive federal funding, you need to understand where every minute goes and whether you can count it toward your grant funds.

While employees might find it easy to use spreadsheets to enter their time, approving time entered, making sure data is being properly imported, and proofreading your formulas can all become extremely difficult when using spreadsheets.

To connect time to wages, you’ll need to make sure you’re recording a complete, accurate, and thorough record of employee time. What does that mean?

- Complete timesheets mean that every work hour is accounted for. In some organizations, this can be as simple as making sure that everyone has worked at least 40 hours during a week.

- Accurate timesheets mean that what’s recorded is an honest representation of how an employee spent their time. Instead of averages and estimates, it shows — down to the minute — where employees’ time went.

- Thorough timesheets include relevant details for your accounting department. This can vary by organization, but an example might be including a brief description of each task performed. This level of detail can help nonprofits in the event of an audit.

You record all of this information in a spreadsheet. However, time tracking software, like fund accounting software, will automate and simplify many of the complex processes behind time tracking. Incomplete timesheets can be automatically sent back to an employee, for example. Tools like stopwatches can help employees record their time down to the minute. And categorizing time entries by custom fields or adding notes to tasks can give accountants and auditors all the detail they need to verify wage allocations.

Whatever tool you use, you’ll need complete, accurate timesheets in order to properly invoice your grantors. With accurate timesheets, you can then run payroll, allocate the right proportion of each employee’s wages to the grants they worked on, and confidently ask for funder reimbursement.

Wage-to-grant Allocations & Time Studies, Part 4:

Monitoring Indirect Expenses

Time tracking is critical when it comes to getting reimbursed for employee time spent on programmatic activities. But it’s also important for allocating any wages that go toward indirect expenses in the fundraising and management and general categories.

Let’s say you have two grants that fund two separate programs. Grant 1 covers meals for individuals experiencing homelessness. And Grant 2 covers finding and applying for identification documents for unhoused individuals. You operate each program out of a shelter your nonprofit owns.

Because these programs run out of the same center, many of their administrative activities will likely overlap. Without a detailed time tracking system, your nonprofit won’t know how much employee time and wages to allocate to each grant. And without this data, you could end up over-allocating indirect expenses to one grant when another grant could have covered the cost. If you do this too frequently, you could end up burning through funding for indirect expenses for both grants, requiring you to tap into unrestricted funds to cover the difference.

Making sure employees are filling out accurate, complete, thorough timesheets helps you see where you can allocate wages to either fund without using either up too quickly or leaving money on the table.

You can find more information on the importance of time tracking for allocation in our in-depth blog post, “Perfecting Nonprofit Time Studies: The Art of Wage-to-Grant Allocations.”

I say fun because this is the part where you get reimbursed. Most federal grants are reimbursement grants. That means you’ve already spent money up front and must now provide sufficient documentation to show that, according to your grant specifications, you should now be reimbursed.

But when it comes to the documentation process — especially in the context of federal bureaucracy — I’m sure any accountant will tell you it’s a lot of hard work and to track down all the necessary details and numbers.

While the invoicing process will always be… well… a process, there are ways your nonprofit can approach it to make it a little easier on yourselves.

Invoicing Funders, Part 1:

Organize Your Finances Beforehand

As we’ve mentioned multiple times already in this guide, software will become your best friend after receiving federal funding. You’ll understand this personally when it comes time to pull the reports needed for invoices.

Nonprofit accounting software can help you report on all your expenses as they relate to a grant. Time tracking software can provide you with data to justify your payroll expenses. And grant management software will help ensure you’re sending invoices and reports at the right time.

If all of these systems integrate with each other, you can easily pull necessary data from each of them to create financial reports for funders.

Invoicing Funders, Part 2:

Understand Your Invoicing CalendarAs soon as you receive a grant, make sure everyone in your organization understands important deadlines. These could include milestone and progress reports, as well as an invoicing timeline.

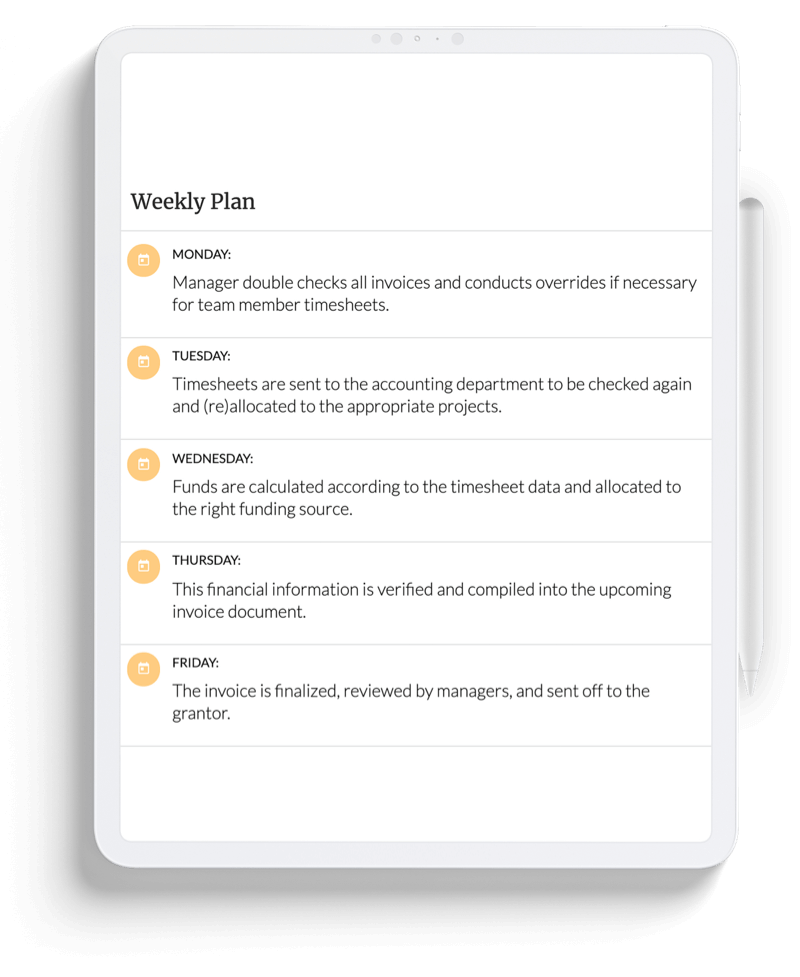

Create a timeline that specifies your deadlines for each invoice, and work backwards from there to make sure you’re not scrambling to put information together at the last minute. A plan to prepare everything for an invoice could look something like this:

Share this calendar or schedule with everyone involved in the invoicing process so they can help you meet your critical deadlines.

Invoicing Funders, Part 3:

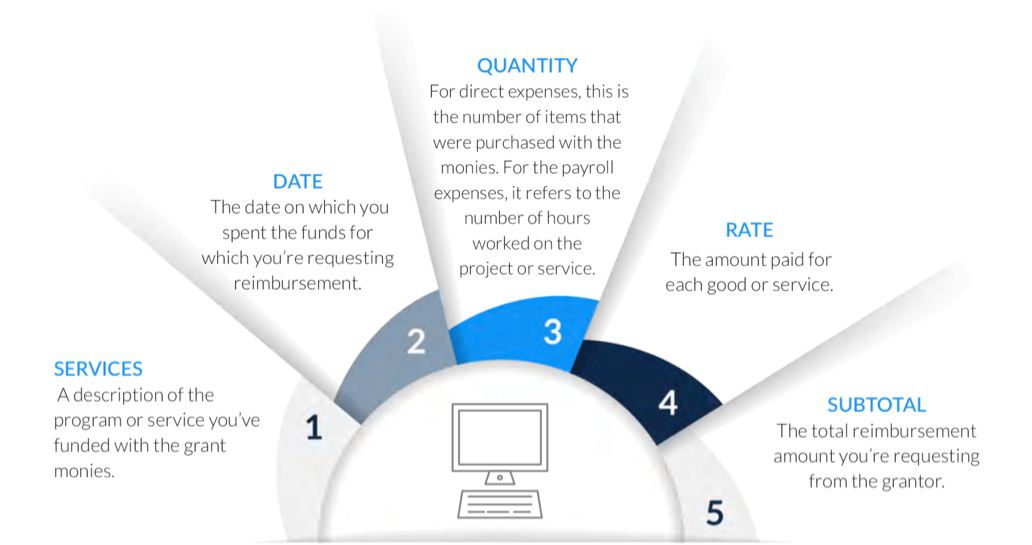

Use a TemplateThere’s no need to start from scratch every time you send an invoice. A template can make this process more of a fill-in-the-blank exercise.

Most grant invoices will include the following categories:

- Services — A description of the program or service you’ve funded with the grant monies.

- Date — The date on which you spent the funds for which you’re requesting reimbursement.

- Quantity — For direct expenses, this is the number of items that were purchased with the monies. For the payroll expenses, it refers to the number of hours worked on the project or service.

- Rate — The amount paid for each good or service.

- Subtotal — The total reimbursement amount you’re requesting from the grantor.

Don’t forget to make your invoice professional by putting your nonprofit logo and colors on it before sending it out.

Check out our in-depth blog post, “Nonprofit Finance: The Fastest, Most Accurate Way to Invoice Your Funders,” to learn more about the nonprofit invoicing process.

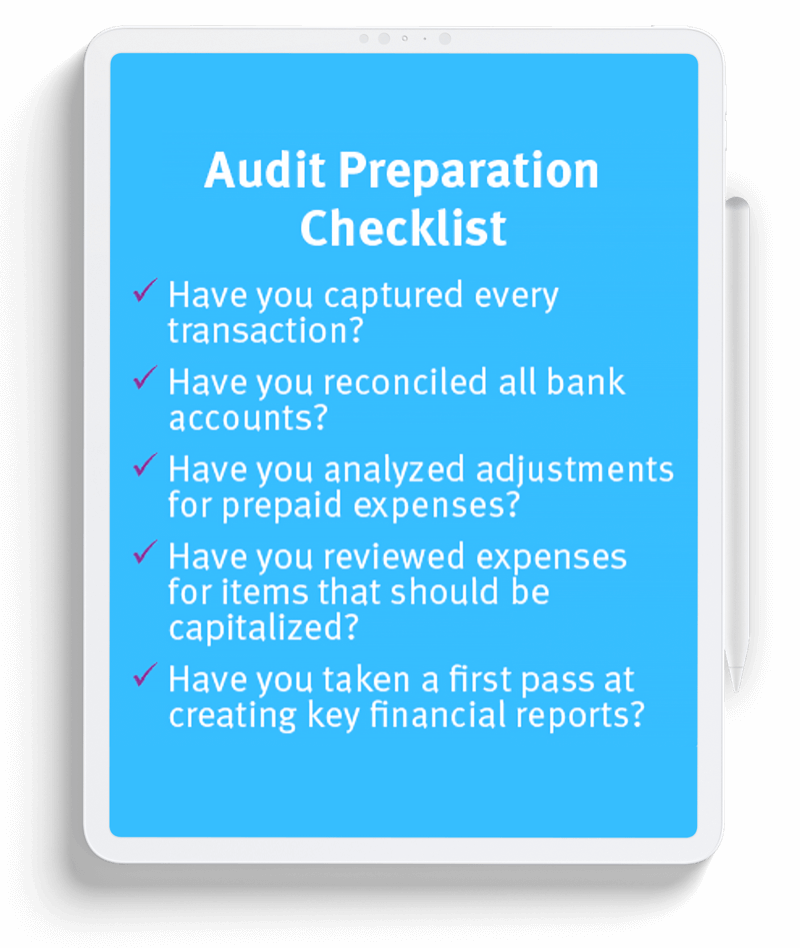

Like invoicing, a financial audit involves gathering lots of information and records to hand over to the government. By creating a process around audits, your organization can prepare and be ready for an audit anytime it happens.

Passing Any Audit, Part 1:

Get Your Systems of Internal Control Under ControlI’ve said it before (many times) in this guide, and I’ll say it again: you need fund accounting and time tracking software. When it comes to receiving and tracking large sums of federal money, you’ll need pristine data you can hand over to auditors.

Spreadsheets might have worked when you were receiving small grants or operating off of unrestricted individual donations. But the federal government demands a detailed audit trail to account for spending.

Software will help you create a compliant audit trail and make sure you can stay on top of all the spending data you’ll generate with federal grant.

Passing Any Audit, Part 2:

Assemble Your Team

Gathering all the necessary information for an audit will inevitably be a team effort, even if software makes it easier to locate. Assemble your team members to create a process and timeline to prepare for upcoming audits. Make sure everyone knows their deadlines and responsibilities to make the process efficient.

Passing Any Audit, Part 3:

Gather Your DocumentsIf you have an organized process and software helping you gather data throughout the year, assembling the proper documentation should be relatively easy. But it will still take time to collect all the necessary financial paperwork, reports, and statements you’ll need to hand over to an auditor.

Common documents you’ll need to provide include:

This list will give you a good head start in gathering documentation. However, you should make sure you double-check any list your auditor gives you to make sure you have all the necessary information.

Passing Any Audit, Part 4:

Plan to Share (and Follow Up On) Audit Results

No matter what the results of your audit are, you need to share them with relevant team members and your board. An audit is essentially a report on the financial health of your nonprofit. It’s also a measure of whether your nonprofit is managing federal funds responsibly.

If you’ve passed an audit but need to make minor improvements or adjustments to your processes, your board and team need to know what that means for your nonprofit overall. And if you didn’t pass an audit, you’ll need to work together to come up with a plan to make necessary changes in a timely manner.

Learn more about the auditing process in our in-depth blog post, “How to Easily Pass Every Nonprofit Audit.”

Federal Grants, Section VII:

Win the Grants Your Nonprofit Wants and NeedsFederal funding can open lots of doors for nonprofits. With larger amounts of funding coming in, your organization can do more work to advance your mission. But the tradeoff is also doing more work behind the scenes to ensure your federal funds are spent in a compliant, responsible way.

Payroll spending is especially tricky to keep in check. With more funding for salaries, you’ll have more people on the ground. That means tracking more workflows, more wages, and more money flowing to different programs. It also means more room for error.

With the right systems in place (namely accounting and timesheet tools), you can track payroll expenses in real time, course correcting if anything goes wrong. Your nonprofit can do the work it always wanted to do. And you can rest easy knowing auditors won’t fault your spending.

Learn how ClickTime’s timesheet software and resource planning tools can help you create and stick to plans for your payroll allocations, boost your reputation as a responsible steward of federal funding, and help you win more grants in the future.