Profit Margins: What They Are, Why They Matter & How to Calculate Them

Table of Contents

Profit margin is arguably the most important metric for any private business out there. Regardless of size or industry, profit margin calculations provide context about the financial health and long-term viability of the company.

In today’s post, we’re going over all things profit margin, including:

- What profit margin is and how to calculate it

- The different types of profit margin calculations you can perform

- Why it’s such an important metric for your business

Whether you want to analyze the profitability of a specific project or assess overall performance, there’s a lot of value that project management, finance, and operations leaders can gain from profit margin calculations.

What Is Profit Margin?

Regardless of the size of your business or the industry you operate in, your company has one main goal: to make money. But with all the costs and expenses that go into operations, it can be difficult to see just how much money you’re making and how sustainable your business model really is.

Profit margin is a profitability ratio that tells you how much profit is generated from every dollar the company brings in through sales. This is accomplished by analyzing the ratio of two key metrics for any business: sales and expenses.

How To Calculate Profit Margin

Calculating profit margin is the same regardless of your industry and whether you’re selling a physical product or service. Here are the steps:

- Take your net sales revenue over a period of time and subtract the cost of goods sold (COGS) to find your gross profit

- Divide your gross profit by your net sales revenue for a ratio of gross profit to sales revenue

- Multiply this number by 100 find profit margin as a percentage

Say you run an accounting firm and charge $15,000 per job. If you pay your employees $10,000 out of that total and have $1,000 in software tool costs, your gross profit is $4,000. Dividing the gross profit by the total sale and multiplying it by 100 gives the business a profit margin of 35%.

In other words, your lawn care service brings in $0.35 of profit for every dollar it sells in services.

Why Profit Margin is Important

For businesses looking to grow quickly, or those beholden to shareholders or investors, the profit margin is a crucial business metric.

As a ratio of sales to expenses, profit margins reveal how much money you are making and represent the overall financial health of your business. Businesses need to pay attention to profit margins to check the pulse of their fiscal health and intervene when necessary.

Depending on the industry you operate in, your margins may be more liable to change and require additional scrutiny. Profit margins provide more contextual financial information to companies than metrics like gross sales, earnings, or business expenses. Margins enable you to:

- Identify your most profitable clients, projects, and employees

- Make decisions to optimize employee performance and reduce overservicing clients

Leaders across finance, operations, and project teams can use different types of profit margin calculations to assess the profitability of their business in different contexts.

Types of Profit Margin

At a high level, all profit margin calculations tell companies how much residual profit there is from sales after paying off related costs and expenses. But, there are different types of profit margin calculations businesses can perform to evaluate financial performance in more specific contexts.

The major types of profit margin calculations businesses can use include:

- Gross margin

- Operating margin

- Pretax margin

- Net margin

Gross Profit Margin

Gross profit margin, sometimes referred to as gross margin, is a measure of a company’s raw profitability. It’s a key metric indicating the amount of revenue remaining in a given accounting period after a company pays for labor, materials, and other costs of goods sold.

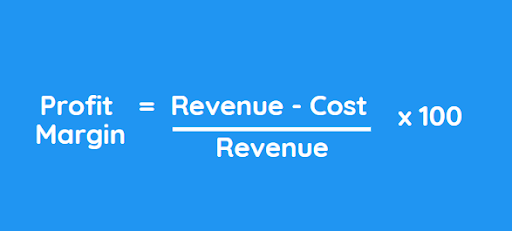

Gross profit margin is calculated by: taking the company’s net sales, subtracting the COGS, and then dividing that number by the net sales:

One of the most effective applications of gross profit margin is using it to determine the profitability of a product or service suite. Analyzing the gross margin of each individual offering gives great insight into the profitability of specific projects.

Operating Profit Margin

Operating profit margin measures how much profit a company takes home after paying off variable production costs and before paying interest or taxes. It reflects the percentage of profit a company produces from its operations before subtracting taxes and interest charges.

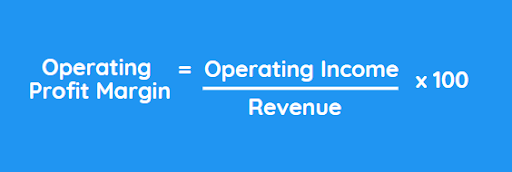

Operating margins are calculated by dividing the company’s operating income by its net sales:

The resulting ratio reflects how well the finance, operations, and project management leaders manage the company to efficiently generate profits from sales. Analyzing operating margins can also help leaders identify when inflation eats into company profits.

Pretax Profit Margin

Pretax profit margin is a ratio that tells us the percentage of sales that have turned into profits before deducting taxes. It’s different from the operating margin in that it calculates how efficiently the company is operating with interest included.

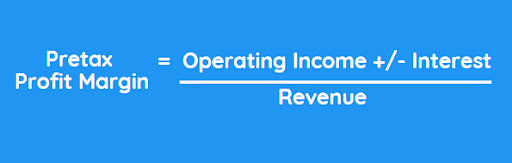

Pretax margins are calculated by taking the company’s earnings before tax (EBT) and dividing it by revenue:

The pretax margin tells business leaders how effective they are at maintaining a healthy balance between reducing costs and increasing sales.

Net Profit Margin

Net profit margin is what most people mean when they refer to “profit margin.” It is the percentage of sales revenue you have left after deducting operating expenses, interest, income taxes, and other relevant costs and expenses.

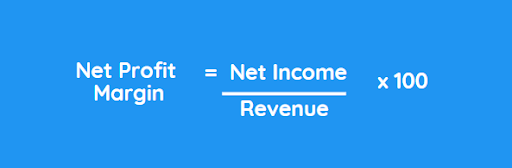

There are a few ways that businesses can calculate their net profit margin. You can divide net profits by net sales or net income by realized revenue over a certain period of time.

Analyzing the Profit Margin Formula

A profit margin analysis measures what percentage of sales comes from net income. Margin analysis helps companies determine their ability to generate income relative to their revenue.

Is the juice worth the squeeze, or does something need to change operationally to improve

profits?

Absolute numbers like net earnings may seem impressive, but they lack context and make it difficult to compare one company’s profitability with similar-sized operators. Margin refers to earnings expressed as a percentage of sales, making them ideal for comparisons.

Using Profit Margin

Profit margin has been used as a key business metric for decades, providing everything from projections of future performance to identifying projects that bring down profits. They are crucially important to monitor the health of an individual business.

But they can also reveal broader trends at the industry level.

For instance, investors, shareholders, and financial institutions can use aggregate margin data to identify industries that are most likely to generate a high return per unit sold.

Examples of Low-Profit Margin Industries

Industries with low-profit margins get a low, and even negative, return on investment for each unit they sell — whether that unit is a quarterly consulting retainer, a bulk order of medical equipment, or a newly-constructed condo. These low returns could be due to the resource-intensive nature of the product, low project pricing, or high operating costs.

According to Statista, some of the lowest profit margin industries include:

- Green & Renewable Energy

- Internet Software

- Coal & Related Energy

- Real Estate Development

- Biotechnology

Each of these industries involves the production or delivery of physical products and services, meaning various costs and expenses eat into sales revenue. In some industries, like energy production, companies even operate with a negative margin.

Examples of High-Profit Margin Industries

Industries that enjoy high-profit margins generate a high return on each service project. They typically have a low COGS, overhead, or related expenses and therefore keep more of the sales as profit.

According to research firm IBIS, some of the highest profit margin industries include:

- Financial services and exchanges

- Tax preparation software

- Commercial and land leasing

- Trusts and Estates

These highly-profitable industries are generally low COGS and based on the provision of digital service, meaning more of the money brought in through sales flows directly to company profits.

Increase Your Profit Margins with ClickTime

ClickTime provides a quick, easy method for business leaders and stakeholders to assess which employees, clients, and projects are most profitable.