Take full advantage of valuable R&D tax credits

Claim R&D Tax BenefitsWith ClickTime, you can audit-proof your tax credit claims by clearly documenting the expenses assigned to qualifying research activities. Capture all R&D project efforts in real-time, send workflows for approval, and rest assured that you can pass any audit that comes your way.

Get Realt-Time Visibility Into Your R&D Efforts

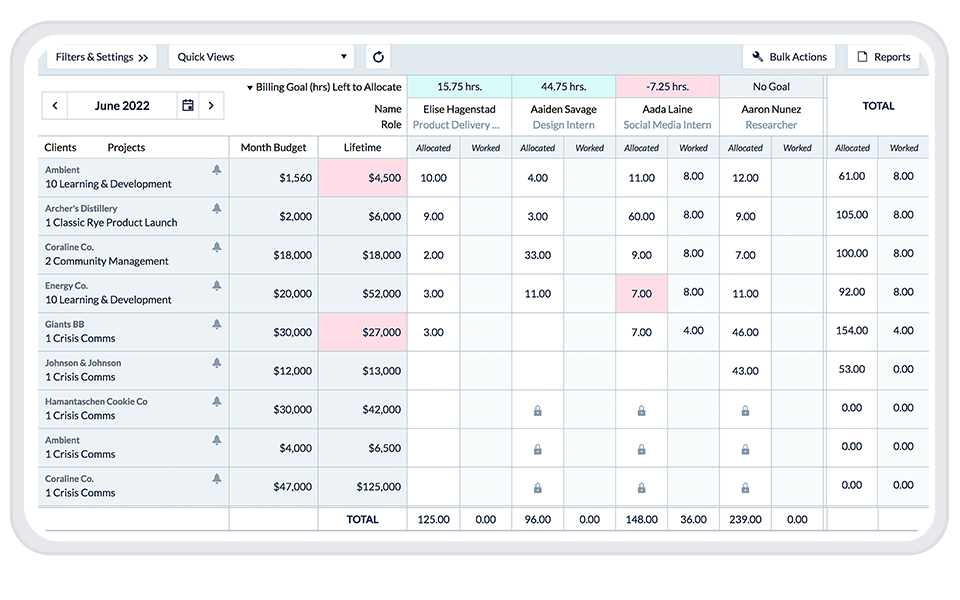

Estimate Claim PotentialClickTime helps organizations estimate their R&D tax credit claims by providing a centralized view of all project and resource costs.

- Resource-Level Cost Designation: ClickTime automatically estimates the cost of every hour your employees work, allowing you to easily estimate claim potential.

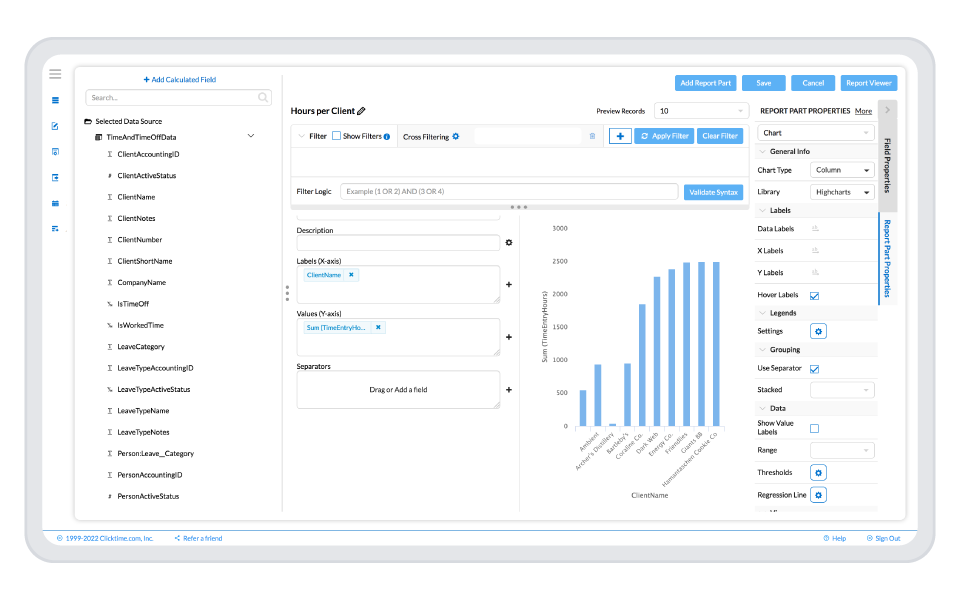

- Project Progress Updates: See how every project is progressing, including information on estimates vs. actuals.

- Historical Project Data: Reference past projects to help forecast future credit potential.

Document with precision

Pass Audits with Flying ColorsWith an accurate and complete paper trail, your accountant will be able to claim tax credits with confidence.

- Export Audit Logs: Use audit logs to show every save, edit, deletion, approval and override.

- Validate Your Data: Use timesheet validation measures to reduce human error.

- Configure Audit Reports: Schedule customized audit reports to be sent to your email inbox.

- Add Timesheet Notes: Utilize timesheet notes to record detailed context around R&D activities.

Try ClickTime for Free

FAQs

The R&D tax credit is a federal incentive designed to encourage businesses in the United States to invest in research and development (R&D). It allows companies that incur qualified expenses for activities related to their business operations, such as developing new products or processes, improving existing ones, or conducting scientific experimentation, to offset their taxable income.

To claim the R&D tax credit, businesses must identify their qualified research activities, calculate their qualifying expenses, and then apply for the credit using IRS Form 6765. Businesses may also need to submit additional documentation such as invoices or contracts related to their qualifying activities in order to support their claims.

The Tax Cuts and Jobs Act is a comprehensive tax reform package passed by Congress in 2017. It made significant changes to individual and corporate tax rates, as well as to other provisions such as deductions and credits. The main goal of the Act was to stimulate economic growth by reducing taxes and simplifying the tax code.

The IRS requires taxpayers to maintain records and documentation related to their research activities in order to be eligible for the R&D tax credit. This includes documents that demonstrate how the taxpayer conducted its research, such as laboratory notebooks, designs, drawings, and other technical information; as well as financial records showing expenses incurred for qualified research activities. Additionally, taxpayers must also keep track of any agreements or contracts entered into with third parties related to the research activities.

Disclaimer: ClickTime assumes no responsibility or liability for any errors or omissions in the content of this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness, or timeliness. ClickTime highly recommends working with your CPA directly to determine whether your organization is eligible for R&D tax credits.