Labor Cost Capitalization: Why Proper Time Tracking Matters

Table of Contents

If you’re in finance, there’s probably a topic that’s crossed your desk more times than you’d like—allocating labor costs between CapEx and OpEx. How does allocating labor to CapEx vs. OpEx affect the numbers that matter most? And more importantly, why is accurate time tracking key to getting this right? Let’s dive in.

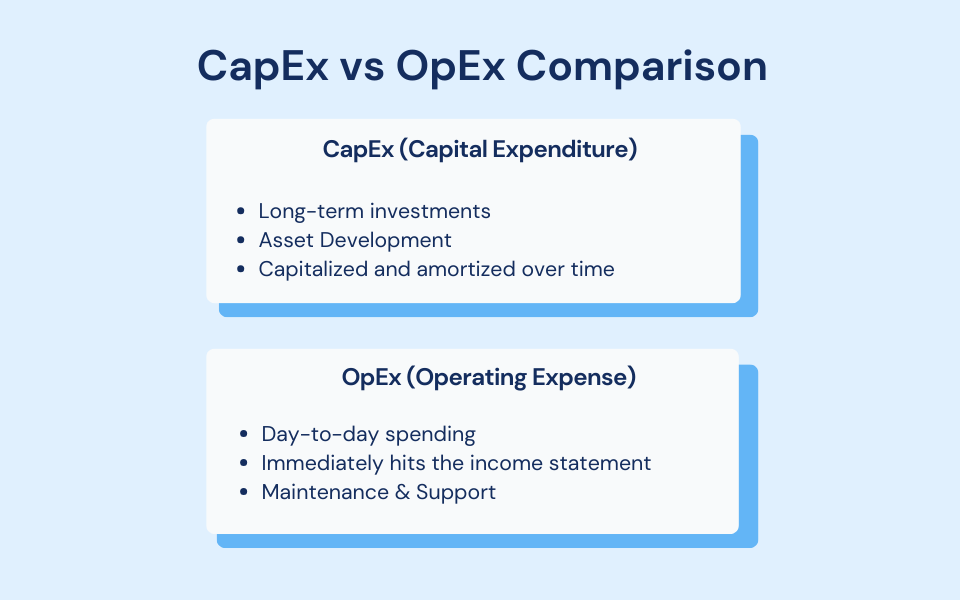

CapEx vs. OpEx – A Quick Refresher

What is the key difference between CapEx and OpEx? CapEx (Capital Expenditures for long-term investments) gets capitalized and amortized over time, while OpEx (Operating Expense for everyday spend) hits your income statement right away. Understanding which bucket to put labor costs in is important. Labor associated with building or improving long-term assets can be capitalized under CapEx. Meanwhile, labor tied to keeping the business running falls under OpEx. Get this wrong, and your financials might be telling the wrong story.

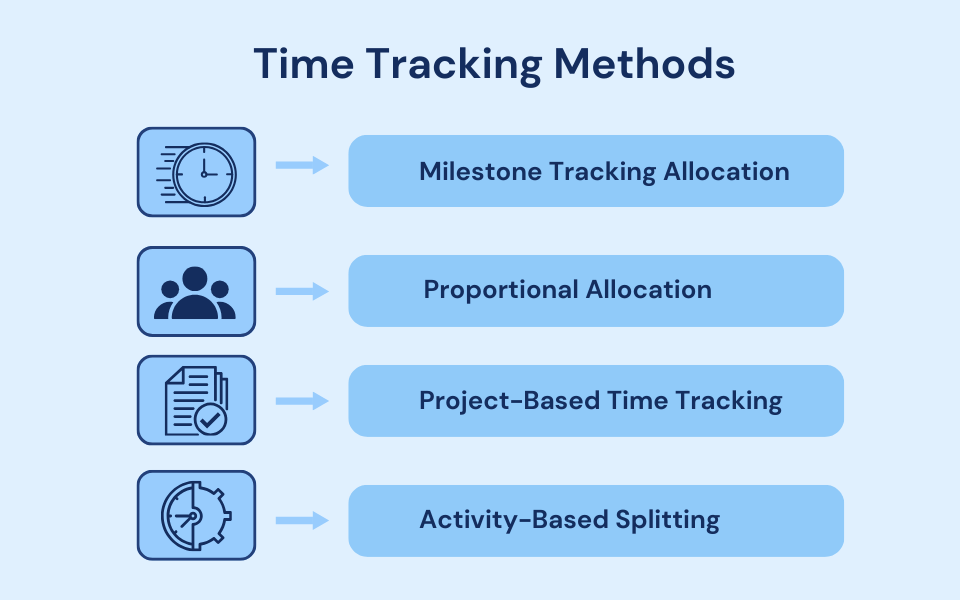

There are several methods to approach this:

1. Proportional Allocation: Sometimes, a more general approach works. If employees generally split their time in predictable ways (say, 70% on operational tasks and 30% on capital projects), you can use that ratio to allocate their labor costs. This method is useful when exact time tracking isn’t feasible, but it’s a bit less precise and may require periodic adjustments to stay accurate.

2. Time-Based or Milestone Tracking: For longer projects, you might choose to allocate labor based on project phases or milestones. For example, during certain stages, all labor might be capitalized, while in others, it’s expensed. This works well for large, multi-phase projects where the nature of the work shifts over time.

3. Project-Based Time Tracking: This is one of the most straightforward methods. Employees log their hours against specific projects. If a project is considered capital in nature, the labor costs associated with it can be capitalized. Meanwhile, time spent on operational tasks is expensed immediately. This method works best when your projects are well-defined, and employees are clear about what they’re working on.

4. Activity-Based Splitting: If employees are working on both OpEx and CapEx tasks, you can split their time based on the nature of the work. This method requires a bit more detail—employees need to track not just the hours they work but also what kind of work they’re doing. Are they contributing to the development of a long-term asset? Or is their work more operational? This method is ideal for organizations with a mix of tasks but requires detailed time tracking.

Whichever method you choose, accurate time tracking is essential. Without a clear, defensible record of where time is being spent, it’s easy to misallocate labor costs, which could lead to distorted financials or issues during an audit. For organizations with a time tracking system in place, like ClickTime’s customers – capitalizing labor is easy because they can clearly show that the work directly contributes to a long-term asset. Time tracking ties all of this together, ensuring your labor allocation is grounded in reality.

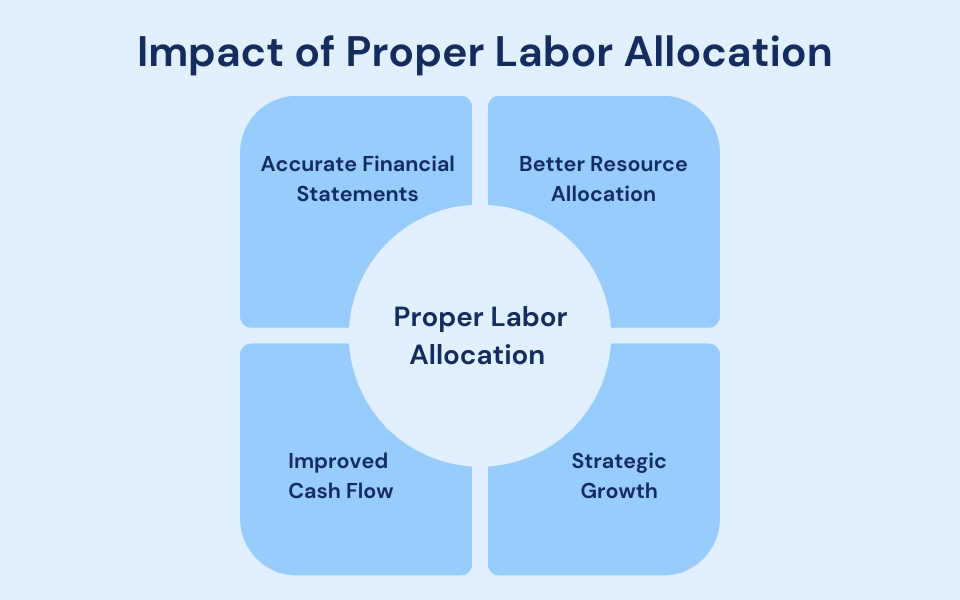

The Organizational Outcomes of Proper Labor Allocation

So, why does all of this matter beyond just balancing the books? When you track your time to allocate labor accurately, your financial statements better reflect the true state of your business. This builds trust with stakeholders and ensures you’re making decisions based on real data, not distorted figures. You’ll have a clearer understanding of where your resources are going and whether they’re being used efficiently.Proper labor allocation can also help you identify opportunities to cut costs or reallocate resources where they’ll have the greatest impact. Aligning your labor allocation strategy with your tax strategy can improve cash flow when the tax bill comes due, and reduce your tax liability over time. It’s about finding the right balance between short-term gains and long-term savings. Ultimately, accurate labor allocation gives you the data you need to make smarter decisions about investments, resource allocation, and future growth. It’s not just about managing costs—it’s about spending strategically to drive value for the business.

For more information on how ClickTime customers breeze through accurate labor allocations, take a look at how CapEx and OpEx tracking actually works in the platform.