How to Write a Grant Budget to Win Your Dream Grant

Table of Contents

Applying for grants can be a frustrating, time-consuming process. Different foundations have different requirements. Funders’ priorities vary based on their foundations’ missions. And the more money you’re asking for — especially if that money comes from the state or federal government — the more you’re asking for scrutiny into your nonprofit’s activities.

And some of the highest levels of scrutiny are applied to your grant budget proposal.

Many organizations take planning seriously when it comes to projects and budgets. After all, you need to know what work you’re taking on, how much it costs, and what your profit margins are.

Table of Contents

1. Implement Systems of Internal Control to Prove Financial Transparency

2. Understand Your Funder’s Requirements

3. Work with Your Team to Estimate Realistic Costs

4. Show The Funder Exactly What Their Grant Will Cover

5. Compare Your Budget to Your Grant Narrative

6. Check Your Work

Since you’re likely asking for a significant amount of funding, it makes sense that the committee reviewing your application wants to see a detailed, accurate budget to understand where their money will go.

But how do you come up with the numbers you need to accurately represent your program activity? Where do you find historical data to support your projections? And how can you inspire enough confidence in funders to encourage them to write a check?

Keep reading for information on how to write a grant budget that’s detailed, evidence-driven, and representative of your nonprofit’s mission.

The Purpose of a Grant Budget

Grant budgets are only one small part of a grant proposal. However, when it comes to applying for competitive grant funding, the budget is arguably one of the most important parts. With many organizations competing for funding, a grant budget proposal is one of the more objective components of your application. It includes hard numbers that funders can verify if necessary, and it will be an important document to refer back to if you receive funding.

Overall, the purpose of a grant budget proposal is to:

- Serve as proof that your organization has considered the true costs of running your project or program.

- Show funders exactly how much a project or program costs — and, therefore, how much you actually need funding relative to other organizations.

- Demonstrate how your nonprofit will put competitive funds to good use compared to other nonprofits applying for funding.

So not only is creating a grant budget an exercise in financial responsibility for your organization, it’s also necessary to help funders see your organization as worthy of the funding — especially in comparison to other organizations who could also put the funds to good use.

How to Write a Grant Budget in 6 Steps

Since your grant budget proposal is one of the most heavily weighted parts of your grant application, it’s important to get it right. Keep reading for an overview of what goes into writing a grant proposal budget.

1

Implement Systems of Internal Control to Prove Financial Transparency

When you’re applying for federal grants, there’s a serious need for transparency around your nonprofit’s bookkeeping methods. The federal government is handing over significant sums of taxpayer dollars, so they expect to know that every single cent will be spent wisely.

To ensure maximum accountability, federal grants suggest that all nonprofits implement systems of internal control to track all grant-related expenditures. These systems help you track and account for every cent received from a grant and how it’s spent. They range from creating strict processes surrounding accounting procedures to using software to automate tracking.

Common examples of systems of internal controls

- Using timesheet software to allocate salaries to various functions and audit-ready timestamps for timesheet entries.

- Creating a process for writing checks and sending payments.

- Using accounting software (rather than spreadsheets) to automate, organize, and timestamp general ledger entries.

Having the controls in place prior to submitting the application demonstrates that your organization is committed to and prepared for taking on new funding sources. It might even differentiate you from other applicants that don’t have systems in place for reporting.

2

Understand Your Funder’s Requirements

The first step in creating a grant budget is understanding what your funder’s requirements are. Your overall grant application should align with the funder’s interests, scope, or mission. However, your grant budget often requires adhering to funders’ specific requests or preferences.

Below are a few of the most important requirements to consider when creating a grant budget proposal.

Amount Requested

First, you need to know how much you can or should request from a funder. Sometimes grantmakers outline funding amounts very concretely, providing a range or a cap on the money an organization can expect to receive.

If a funder hasn’t provided a range or cap, deciding on a reasonable request might require some digging. In that case, you have a couple options:

- Call the funding source for more information and guidelines.

- Track down how much the grantmakers awarded to grantees last year using their IRS Form 990 information.

- Use a tool like Foundation Directory Online or look at public records to find a typical grant amount.

Format

If you decide to move forward with your application after understanding how much you can expect to receive, it’s time to format your budget correctly.

Many funders provide templates for grant budgets. If that’s the case, make sure your budget ends up in the correct format — even if you do your own calculations in a separate spreadsheet. If no template is provided, you can always use a free grant budget template online to help you understand what to include or follow examples of grant budgets created by other organizations.

At the end of the day, you should present your budget in a format that’s easy to understand. Include and emphasize important information, like cost categories, so funders know what you’re asking for and how it aligns with your overall mission.

Budget Type

Following the correct format also means knowing how much information to include. Some funders only need to know a program budget, but others might require your organization’s overall budget.

Your budget type will also depend on the timeframe of the grant. An annual budget is important for a year-long grant, for example. However, a multi-year grant will require projections farther into the future.

Expense Types, Matching Funds, and Revenue

Finally, you’ll need to understand the different types of expenses and numbers required and covered by a grant. There are several types of expenses you’ll need to consider when creating your budget proposal.

Direct expenses

Direct expenses are the funds you’ll need to run your program or project. They include costs such as:

- Personnel or salary for staff hours spent on program activities

- Fringe benefits, such as time off or insurance for the personnel working on your program

- Travel

- Equipment

- Supplies or materials

You can think of direct expenses almost as noun expenses: they’re the people, places, and things you need to run your program. They’re the main component of your grant budget since receiving funding for these types of expenses directly relates to achieving your mission.

Indirect expenses

Indirect expenses are the overhead costs it takes to run your organization. Paying an electricity bill to keep the lights on in your office is a good example of an indirect expense. While you can’t necessarily attribute the cost of electricity to a specific project or program, you could argue that paying your electricity bill is necessary for your staff to complete their work.

Many grants will allow you to allot or negotiate a certain percentage of funding to indirect costs that you incur while running your organization.

Matching Funds and Revenue

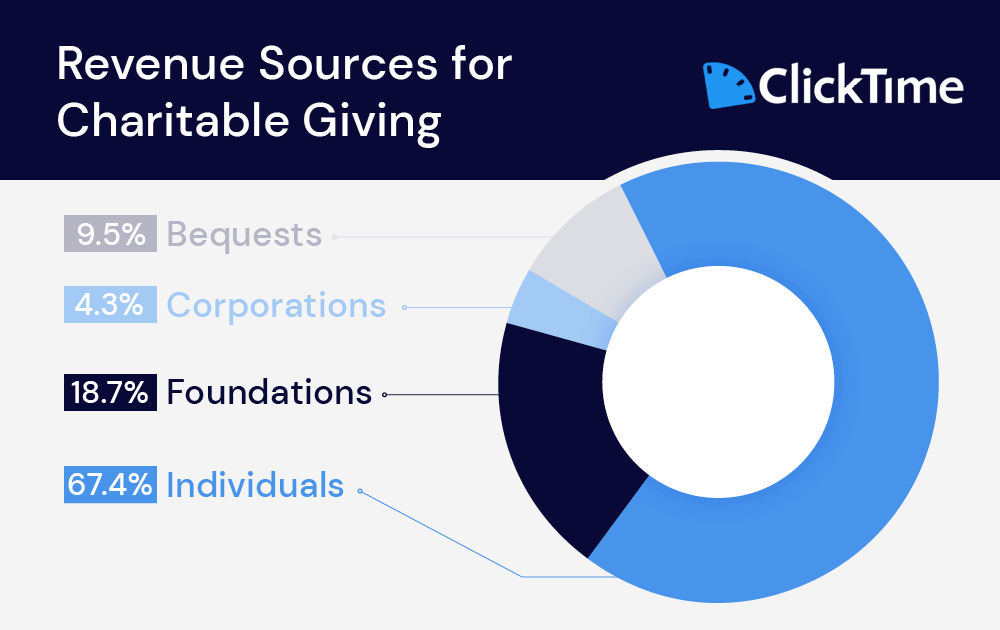

Many grants will require you to show matching funds. However, even if they aren’t required, they’re still a good line item to include in your grant budget. They show that other organizations and community members support your project and think it’s worth funding.

You can also outline other sources of revenue, such as general donations, to show that your program can garner other sources of funding.

3 Work with Your Team to Estimate Realistic Costs

Once you understand what information you need, it’s time to start gathering data so you can come up with real numbers for your budget. And since grant budgets require quite a few line items, you’ll want to call on your team members to help you track down and verify realistic costs.

Realistic costs supported by real data are important for both your nonprofit and your funders. Inflated costs will make your organization appear wasteful, signaling that you aren’t efficient in your operations. And underestimating costs will cause savvy grantmakers to doubt your estimates, or will result in a reduced budget. Underfunding will force your nonprofit to use unrestricted funds to finish a program once grant funding runs out.

Program managers are great resources to start making lists of all the things you’ll need — staff, supplies, services, space — to actually run a program. Accounting can help you estimate associated overhead costs. And some internet sleuthing can help you nail down the costs of supplies or services if you haven’t purchased them before.

Wherever you can, use historical reports and pin down real data to show you’re not pulling numbers out of thin air or making wild guesses about costs.

lightbulb A Quick Tip

Many state and federal grants have stringent rules related to time tracking. By using time tracking software before, during, and after the grant application process, you can:

- Have access to historical data for creating grant budgets by segmenting employee activities into their appropriate functional expense categories.

- Speak authentically to your organization’s overall efficiency and how it positively impacts your mission’s outcome.

- Create a detailed audit trail.

- Inspire confidence from funders by meeting time tracking requirements before they ask you to.

Time tracking software provides historical data to back up your projections. Using the data will help you confidently justify your numbers to funders if there are any questions. And when your realistic numbers are understood and approved, your nonprofit can avoid getting stuck covering unexpected expenses.

4 Show The Funder Exactly What Their Grant Will Cover

After you’ve calculated your costs — and your team agrees that those numbers are both accurate and realistic — it’s a good idea to show funders exactly where their money will go.

For example, if your program will cost $20,000 and you’re requesting $10,000 from a foundation, you can show funders how you’ll allocate their money and where you’ll use matching funds.

Including this level of detail helps demonstrate your knowledge of the funder’s requirements. If a specific grant doesn’t cover overhead costs, for example, you can show how you’ll pay for those without touching a funder’s money. It’s also a good way to show how you’re putting matching funds or other revenue to work to cover the full cost of a program if a grant won’t provide for everything.

Instant Grant & Fund Reporting. Powerful Program Insights.

Learn how you can keep your funding and goals on track with time tracking software built for nonprofits.

5 Compare Your Budget to Your Grant Narrative

A grant narrative is the story of what your nonprofit would do with grant money if you received it, and it needs to align with the logistics of your budget.

A grant narrative needs to encompass the basics of a grant. For example, if you’re applying for a grant to run a year-long program, your budget should include the costs for the entire year.

However, your narrative also needs to line up with your stated mission in receiving the grant. If you’re applying for a grant that will help you operate a free bike ferry to make biking more accessible for local residents (like Vermont-based Local Motion), your budget’s line items should include costs related to that program.

Even the narrative of your grant needs to include concrete, realistic numbers to measure impact. Federal grants, especially, need to understand exactly how you’ll use your funds to create change. Using our more accessible biking example above, you could say that you’ll use grant funds to improve access to all local bike paths in a defined 10-mile radius of all ferry stops, resulting in 5% more use of those bike trails over the next year.

In this case a grant application budget should include line items for ferry operation. But it will also need to include items for measuring outcomes. Surveys, check-in points on trails, a volunteer standing by making tally marks — calculating and considering the costs of these impact measurements will all have to show up in your budget so they can be covered by funding.

In short, after you’ve added up all your numbers, you need to make sure they tell the appropriate story and help you demonstrate that you’ll be able to report on your progress along the way. If it’s not clear how a specific line item connects to your grant narrative, you can always include footnotes to add clarifying details to your story.

6 Check Your Work

A simple mistake could mean the difference between receiving funding and being denied. No matter how confident you are in your numbers, make sure to double-check your calculations and ensure your budget is error-free.

Get Your Systems of Internal Control Under Control

While accounting tools such as QuickBooks or payroll software are often no-brainers for nonprofits who need to keep track of every penny, many organizations don’t think about timesheet software until grant reporting requires it. But having the tools and processes in place to track time according to grant requirements gives funders confidence that your organization is already operationally ready to take on grant funding.

Time tracking tools can bolster the credibility of grant applicants by showing a well-thought out commitment to execution, tracking, and transparency.

ClickTime is a timesheet system that makes time tracking easy, so you can ensure that your employees’ timesheets are both accurate and complete. Features like Time Entry Completion Reports and Reminder Notifications also make timesheets easy to review and approve, even for busy program managers. And using custom fields to match tasks to functional expenses will help your nonprofit keep an eye on overhead costs.

With a detailed report of how time is spent across your organization, you can identify inefficiencies so everyone can spend more time servicing your nonprofit’s mission. And those details can help you write more authentic budget proposals that showcase your low “management and general” expenses so grantmakers can rest assured that their money will be spent to meet your program goals.

Request a demo of ClickTime to see how our timesheet software can help your nonprofit win competitive grants with confidence.