Why Spreadsheets Are Failing Your CapEx Tracking—and What to Do Instead.

Table of Contents

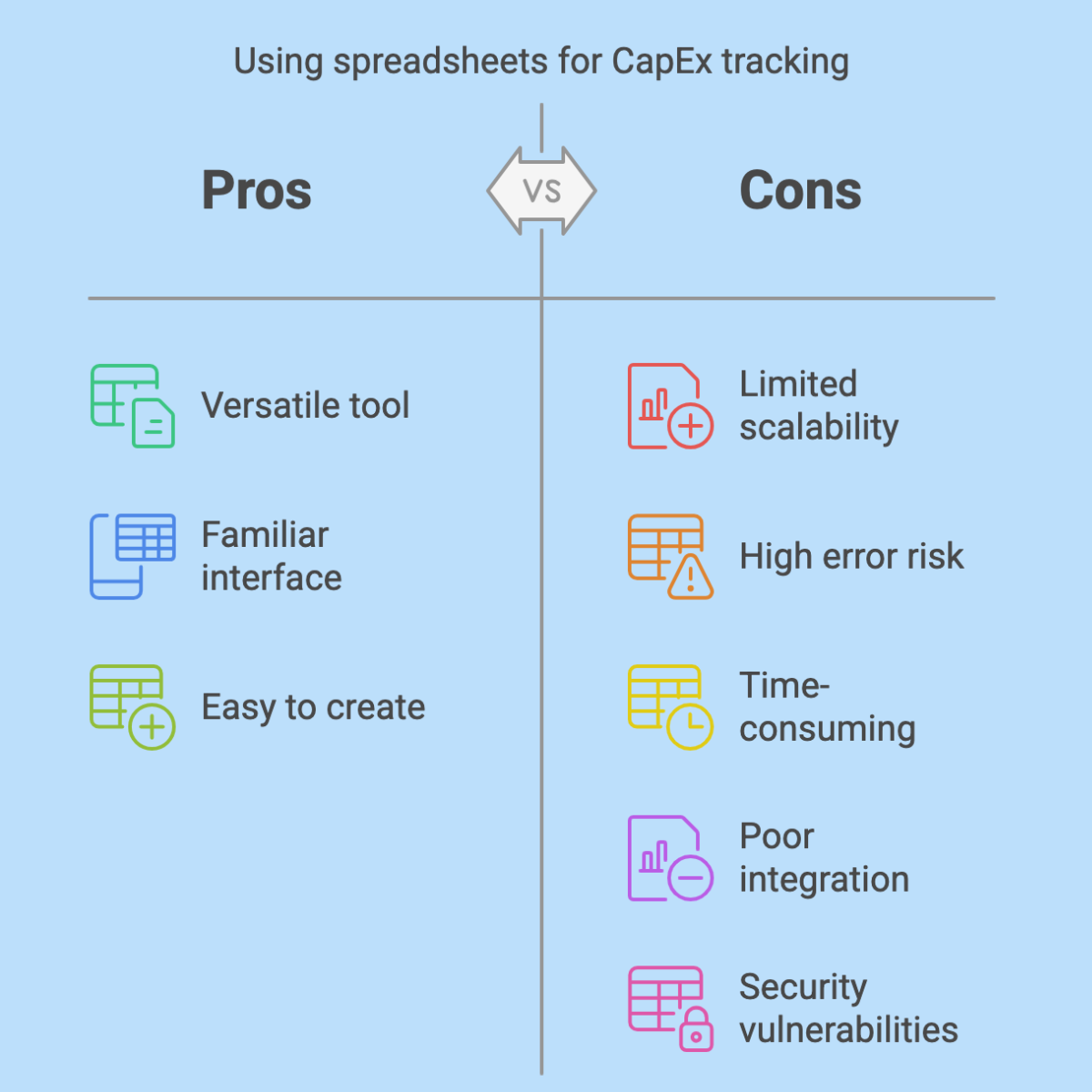

We all love a good spreadsheet—versatile, familiar, and seemingly reliable. But when it comes to tracking Capital Expenditures (CapEx), that trusted tool can quickly become a liability. While spreadsheets may appear sufficient at first, their limitations become painfully clear as spending grows, budgets tighten, and auditors come calling.

The Hidden Risks of Using Spreadsheets for CapEx Tracking

1. The Illusion of Control

A spreadsheet might appear structured and reliable, but it lacks real-time financial tracking capabilities. A single mistyped formula can lead to budgeting errors, inaccurate forecasts, and misinformed decision-making. Without live data updates, financial teams risk working with outdated numbers.

2. Spreadsheet Fragility & Security Risks

Spreadsheets are vulnerable to versioning issues, accidental overwrites, and unauthorized access. Files are frequently emailed back and forth, making it difficult to track changes or ensure data integrity. Without proper audit trails, businesses face increased risks of errors, compliance violations, and even fraud.

3. Time-Consuming Manual Processes

Automated CapEx tracking is essential for efficiency, yet spreadsheets demand hours of manual updates, cross-referencing, and troubleshooting. Financial teams should focus on strategic budget management, not data entry and spreadsheet maintenance.

4. Poor Scalability & Lack of Integration

As companies scale, financial tracking becomes more complex. Spreadsheets do not integrate with enterprise financial management systems (FMS), creating inefficiencies and potential reporting errors. Businesses need a scalable CapEx tracking solution that seamlessly connects with their existing financial infrastructure.

5. Data Inaccuracy & Financial Risks

Studies show that 88% of spreadsheets contain errors, and even small miscalculations can lead to significant financial discrepancies. In some cases, spreadsheet mistakes have resulted in billion-dollar losses. For large organizations, these risks are simply too great to ignore.

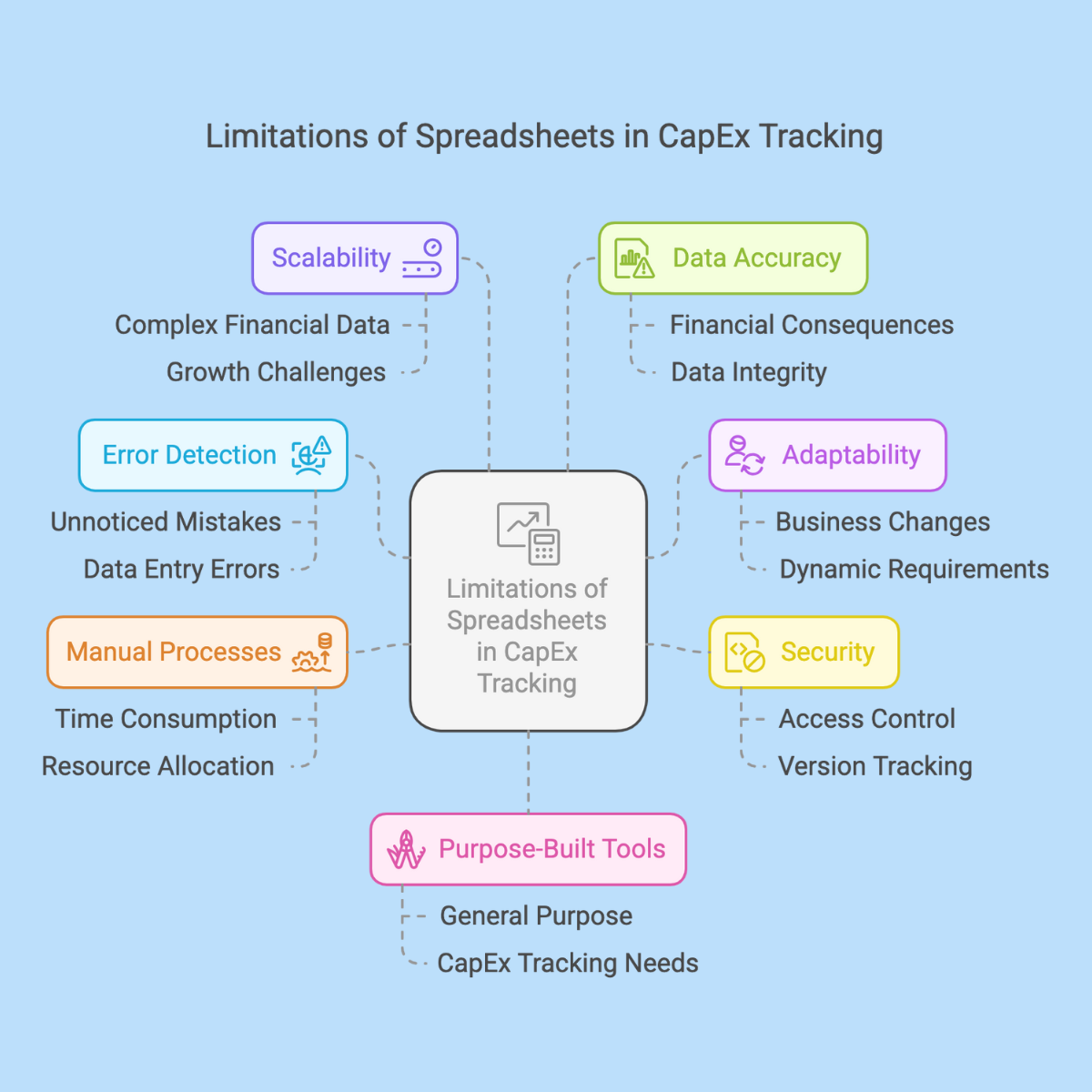

Why Spreadsheets Fail at CapEx Tracking:

- No Error Detection: Prone to unnoticed mistakes.

- Limited Adaptability: Struggles with evolving business needs.

- Lack of Security: No access control or version tracking.

- Manual & Time-Consuming: Requires ongoing effort to maintain.

- Poor Scalability: Can’t handle complex financial tracking.

- Data Inaccuracy: Errors can lead to significant financial consequences.

- Not Purpose-Built: Spreadsheets are general tools, not designed for CapEx tracking.

A Smarter Way Forward

CapEx tracking demands precision, automation, and real-time visibility—capabilities that spreadsheets simply don’t offer. Specialized software, like ClickTime, provides:

- Live Updates: Ensure accurate, real-time financial data.

- Automation: Reduce manual work and generate audit-ready reports.

- Seamless Integration: Sync with financial systems effortlessly.

- Control & Compliance: Set spending limits and track CapEx vs. OpEx with ease.

It’s Time to Move On

Spreadsheets have their place, but when it comes to managing critical financial processes, they fall short. Relying on them for CapEx tracking leads to inefficiencies, errors, and unnecessary risk—especially as businesses grow. It’s time to adopt a smarter, more efficient solution.

Ready to take control of your CapEx tracking? Explore ClickTime today.