Overtime for Salaried Employees

Salaried employees can receive overtime payment just like employees who work and are paid hourly.

Overview

Simply putting an employee on salary will not negate any overtime payments for extra hours worked. Granted, tracking overtime with salaried employees can be a bit more challenging than with with hourly workers. Salaried employees may be exempt from overtime if they make a certain amount or perform specific duties that are not recognized as eligible for overtime pay.

Which Salaried Employees Can Receive Overtime

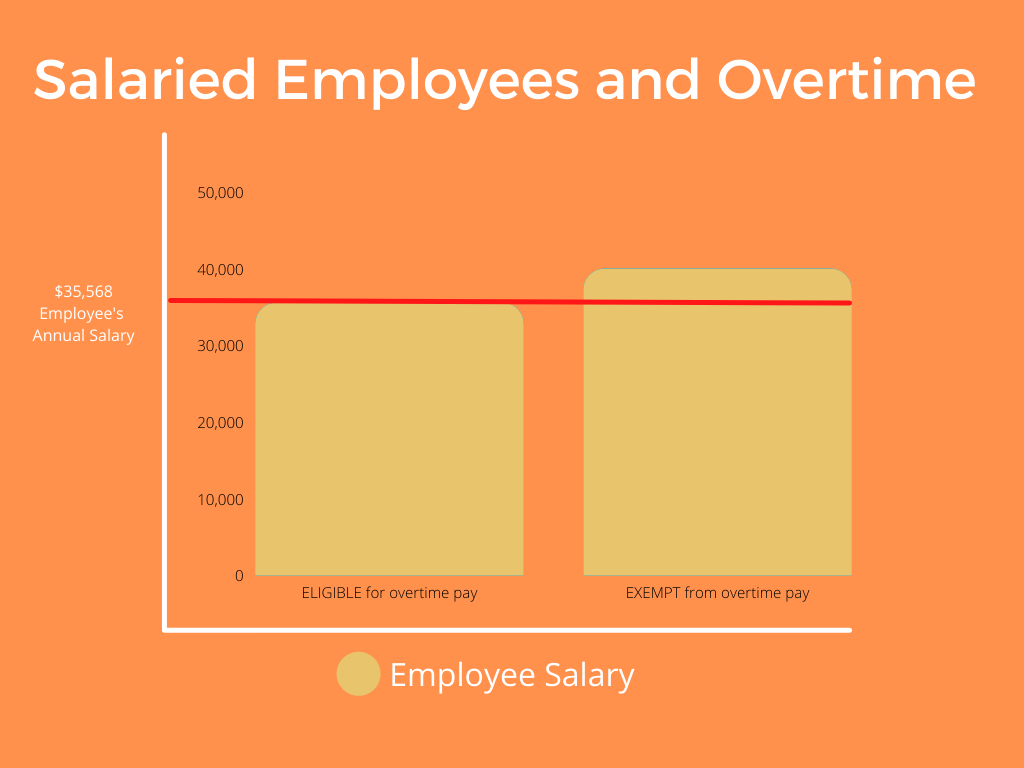

As of December 1, 2016, the ceiling for mandatory overtime payment will be a salary of $684 per week or $35,568 per year for white collar workers. This means that many — but not all — employees with a yearly salary at or below $35,568 are entitled to mandatory overtime pay for any hours worked over 40 in a week.

Overtime pay is 1.5x times an employee’s normal salary per hour. If they are eligible and work more than 40 hours in a week, that rate must be paid in their next paycheck for every extra hour worked. Vacation and sick days do not count toward the total hours worked in a week in most cases, however exceptions do exist in some circumstances depending on the business.

Different overtime rules apply to employees who are typically considered to be blue collar workers , those who perform work involving repetitive operations with their hands or physical skill, or workers performing typically dangerous work, such as police officers, state troopers, correctional officers, park rangers, fire fighters, paramedics, emergency medical technicians, ambulance personnel, rescue workers, etc.

Which Salaried Employees Are Not Eligible to Receive Overtime

There are quite a few classifications of work that deem employees ineligible to be paid overtime. These specific duties are outlined here.

If an employee is paid a salary of over $684 per week or $35,568 per year, then they are not qualified for mandatory overtime pay. (This ceiling will likely raise over time, as automatic updates to the weekly and yearly payment ceilings for mandatory overtime are planned.)

There are plenty of special exemptions for overtime pay by the FLSA. Many of these include commission-based pay structures and blue-collar jobs. For full details, you can visit the Department of Labor Exception Page.

How to Avoid Overtime Costs for Salaried Employees

Keeping track of employees and how long they are working is the first step to getting a handle on overtime. Time tracking is a must for all employees who are eligible for overtime pay. By looking at their time data, a manager can how an employee is spending their time and can help to expedite their projects, reallocate their hours, or change their role or compensation to stay within compliance with the federal overtime law.

Another way to avoid overtime payment is to make sure that an employee is being paid above the requirement for overtime exemption. As of Dec. 1, 2016, this amount is $47,476 per year. Raising salaries to be above this threshold will allow employees to work more than 40 hours per week and still be paid by their salary —but not require overtime compensation. For some organizations, it can difficult to decide whether or not to pay employees overtime or to raise their salary.

For “white collar,” salaried employees, you’ll also want to create an after-hours communications policy, and mobile and social media guidelines that help your managers ensure their team is not working additional or unapproved overtime hours.